Inside the Onchain Vault Ecosystem: Asset Issuers, Protocols, and Risk Curators

September 2025

8 mins read

Onchain vaults don’t operate in isolation. They’re embedded in a broader ecosystem that enables capital to flow efficiently, securely, and intelligently through DeFi. From stablecoins to staking derivatives, from lending protocols to automated strategies, onchain vaults sit at the intersection of some of the most important innovations in crypto today.

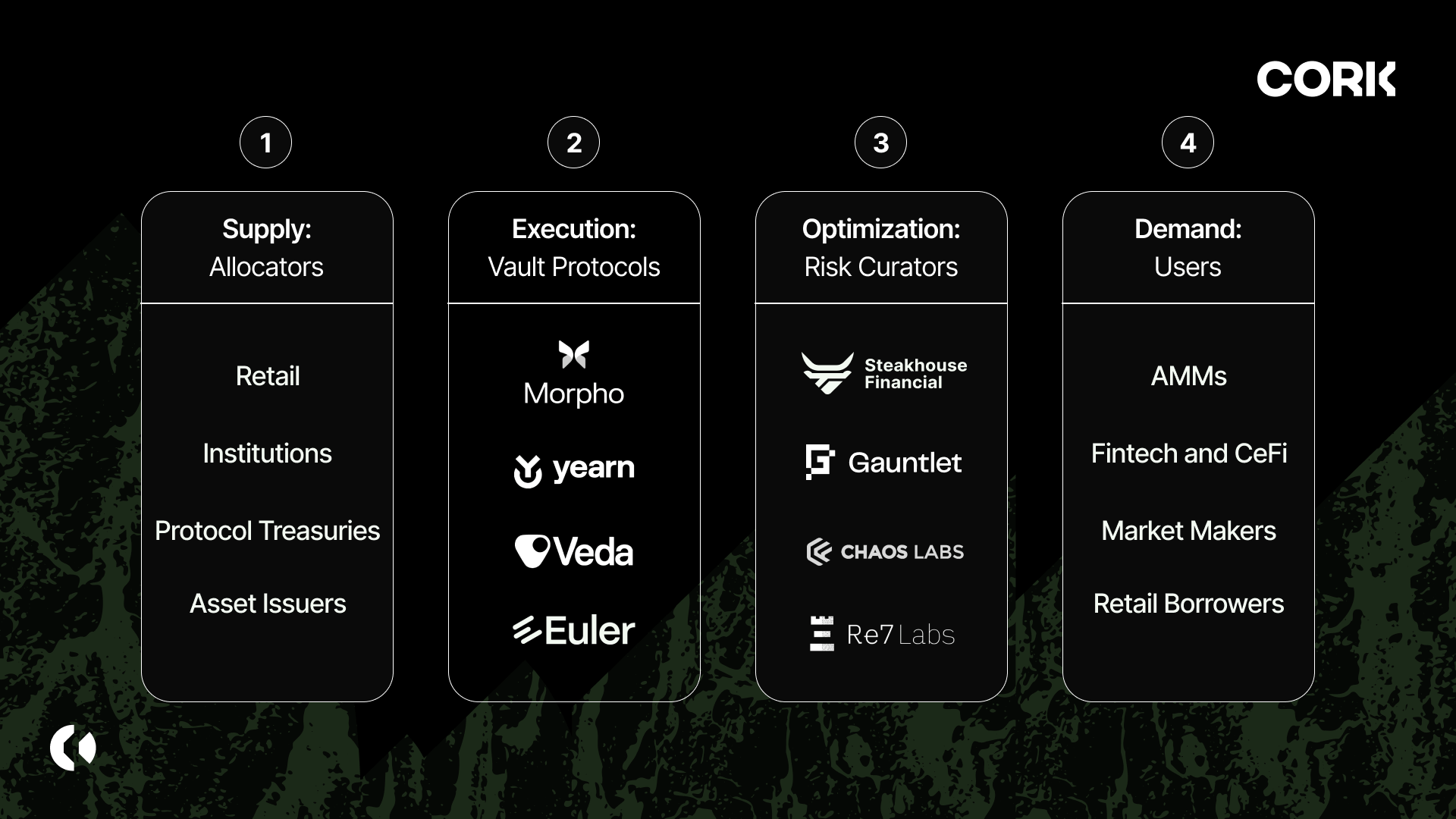

This post explores the key actors in this growing ecosystem and how they shape the future of vault-based finance: allocators as the supply side, vault protocols as the execution layer, and risk curators as the optimizers and guardrails for capital efficiency and security, and finally, users on the demand side.

Allocators: The Supply Side

We can look at the stack for onchain vaults from two sides of a market: a supply side and a demand side. Within the supply side we mainly find allocators, and recently, some asset issuers who’ve become allocators in and of themselves.

Before any strategies are executed, vaults start with capital. That capital often originates from allocators who invest funds into vault protocols seeking sustainable yield by providing liquidity support. They span crypto funds, corporate treasuries, retail users, and an expanding cohort of TradFi institutions entering via permissioned rails.

Nowadays, some asset issuers are evolving and they are no longer just passive creators of stablecoins or staking tokens. Many are becoming active participants in DeFi infrastructure, deploying treasury assets, shaping liquidity flows, and embedding vaults into their product offerings.

Notable Examples

- M11: This crypto fund has deployed over $800M in liquidity since 2022 and remains active through Maple’s 2025 growth phase.

- Apollo and Securitize: The incoming wave of TradFi capital has allowed accredited investors to deposit tokenized fund shares into leveraged vaults with risk controls.

- Frax Finance (FRAX): Deploys its AMO (Algorithmic Market Operations) modules into vaults to optimize yield while supporting FRAX peg stability.

- Lido, Rocket Pool, ether.fi: Leading staking protocols that integrate with vaults to enhance utility and composability of their liquid staking tokens.

Vault Protocols: The Execution Layer

In order to connect the supply side of the market to the demand side of the market we need a main component that matches the needs of the two. Vault protocols fill this gap along with risk curators.

If issuers supply the raw materials, vault protocols are the factories that prepare them for users. They pool deposits, execute strategies, issue ERC-4626 share tokens, and expose a consistent standard so other apps can integrate. The best vault stacks increasingly look like modular platforms: a vault is an ERC-4626 contract, strategies can be swapped in or out, parameters can be permissionless or curated, and everything is designed to compose cleanly with the rest of DeFi.

Notable Examples

- Morpho: aggregated lending via vaults. Morpho pairs lenders and borrowers peer-to-peer for better rates. On top, Morpho Vaults wrap this logic into ERC-4626 products per asset: a USDC Prime vault might allocate only to blue-chip collateral markets while a Frontier vault might reach for higher yield in riskier markets. This framework made it straightforward for Coinbase to launch crypto-backed loans in its main app. By 2025, Morpho reported $12B+ in total deposits across the platform.

- Euler v2: permissionless, programmable credit markets. After rebooting in late 2024, Euler v2 delivered a full Vault Kit so anyone can deploy an ERC-4626 lending vault with custom risk knobs (collateral factors, rate curves, oracles, borrow caps). Markets can be ungoverned with parameters fixed at launch or managed by a curator who can adjust within bounds. This creates a spectrum from trust-minimized to actively managed credit. The design treats each asset as an isolated vault while still enabling shared collateralization via connectors. It’s a powerful mental model for “lending as vaults.”

- Veda: vault infrastructure as a service. Some teams want to ship structured yield products without inventing a vault framework from scratch. Veda’s cross-chain platform provides that scaffolding with a standardized vault primitive used by fintechs, protocols, and wallets to launch curated strategies with clear risk/return profiles. As of June 2025, Veda reported $3.7B+ TVL and 100k+ depositors, an eye-catching growth curve for a vault infrastructure layer barely a year old. It also powers key industry players such as EtherFi Liquid.

- Yearn v3: multi-strategy “allocator” vaults. Yearn’s latest architecture embraces ERC-4626 at the vault and strategy layers. A Yearn v3 vault is an ERC-4626 contract that accepts deposits and then allocates them across multiple tokenized strategies, which themselves are 4626-compatible modules. This gives strategists a standardized interface and lets integrators treat Yearn vault shares like any other fungible, yield-bearing token. It’s a big UX and dev-experience win, and a natural endpoint for aggregator-style vaults.

- Spark (Sky, f.k.a Maker): the single-asset “savings” vault UX. Spark is a Sky-aligned lending front-end, forked from Aave v3. It has one marquee feature: when you deposit stablecoins, Spark routes it into Sky’s Savings Rate and hands you sUSDS: a clean, ERC-4626-style wrapper where yield accrues continuously. It’s a great example of a protocol verticalizing the vault experience for its users and letting the underlying stablecoin machinery hum in the background.

Risk Curators: The Optimizers

Risk curators are tasked with keeping the vault ecosystem healthy. They are specialized teams who set vault parameters, run stress tests, and in some cases handle allocations within managed vaults. Vault parameters typically include:

- Which strategies to allocate to

- How much to allocate to each strategy

- How to manage rebalancing and liquidity buffers

If vault protocols are the factories, risk curators are the quality-assurance teams and portfolio managers rolled into one. These are the teams and protocols responsible for making vaults safe, scalable, and responsive to real-world market conditions.

Notable Examples

- Gauntlet: model-driven vault curation at scale. After years of parameter optimization work for lending giants, Gauntlet now curates families of Morpho vaults with explicit risk bands: Prime (ultra-conservative), Core (balanced), and Frontier (higher-risk/higher-yield). The firm publishes methodology and performance under a VaultBook banner and continuously tunes allocations within pre-declared bounds. The key value prop is discipline: vaults that adapt to market conditions with machine-checked guardrails.

Gauntlet manages a TVL of $1.41B across curated Morpho lending vaults, plus strategy vaults on Drift, Symbiotic, and treasury strategies on Aera. Their site aggregates these under a VaultBook.

- Steakhouse Financial: from Sky core unit to multi-chain curator. Steakhouse began inside Sky’s ecosystem and now advises or curates lending vaults across EVM and Solana. Recent governance posts describe Steakhouse as the largest lending vault curator across EVM and detail contributions from Spark to Morpho and LST integrations, as well as planned curation for Solana’s Kamino Lend v2.

Steakhouse manages a TVL of $1.28B, primarily on Morpho curated lending vaults. It is also an official risk contributor for Kamino Lend V2 on Solana with Earn/USDC Prime vaults live.

- Re7 Labs: practitioner-led vault management. Re7 has deployed liquidity in DeFi since 2019 and now serves as an official risk contributor for Kamino Lend v2 on Solana, managing vaults with distinct mandates under Kamino’s modular Markets + Vaults architecture. Re7’s role is part strategist, part risk officer: selecting markets, monitoring drawdowns, and adjusting dials to keep risk within target bands.

Re7 Labs manages a TVL of $610M curating vaults across Euler, Mellow, Turtle Club, and Morpho. Just like Steakhouse, it is an official risk contributor for Kamino Lend V2 on Solana and involved in Kamino Earn/vaults.

- Chaos Labs: programmable risk for blue-chip protocols. Not every curator manages vaults directly. Chaos Labs builds risk oracles and automation that governance can adopt to keep parameters fresh. In late 2024, Aave integrated Chaos Labs’ Edge Risk Oracles to automate and speed up changes like liquidation thresholds and supply caps, moving the industry from manual parameter updates to near-real-time risk management. That same tooling mindset is increasingly being applied to vaults themselves.

Chaos Labs does not manage deposits directly and specializes in selecting lending market parameters such as LTVs and rate curves.

Users: The Demand Side

The liquidity that’s brought by the supply side of the market is coordinated by vault protocols to match the needs of the demand side. This is where capital is needed to provide services such as market making and supplying lending markets.

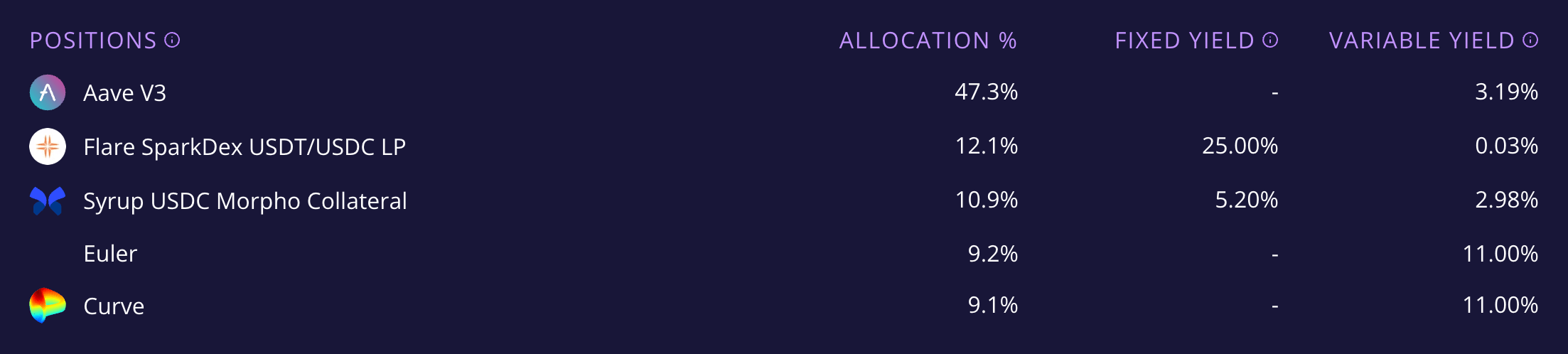

These market participants mostly consist of CeFi, market makers, and retail borrowers who absorb capital in return for yield. Many popular vaults are known for allocating a significant percentage of their funds to bluechip AMMs and lending markets, as a look under the hood might show. These markets absorb the vault’s capital in exchange for fixed or variable yield.

Notable Examples

- Ethena: As an asset issuer, the protocol uses delta-neutral strategies such as long staked ETH and short perps to hedge and collateralize its synthetic dollar and has become a large source of vault yields.

- Coinbase: The CeFi giant’s partnership with Morpho comes up again as a great example of where vault protocols act in the background to meet end-users and retail borrowers. Coinbase facilitates capital to its wide user base by abstracting away Morpho’s vault framework and letting them borrow against their BTC.

- Wintermute: Leading market makers can offer liquidity to vaults as part of their services, but usually their participation is disclosed when they act as borrowers. Wintermute has been known to borrow capital from protocols such as Maple Finance.

Putting It All Together: The Vault Stack

When you put the pieces together, you get a clean mental model for the participants that span across the supple side and demand side, with vault protocols and risk curators as the connective tissue:

Allocators → Vault Protocols → Risk Curators → Users.

- Allocators represent the supply side of the market. They allocate funds into vault protocols and ensure that these markets remain liquid enough to supply the demand for capital coming from users. At the same time, they expect yield from their services and allocate accordingly.

- Vault protocols provide the execution engine: ERC-4626 contracts that pool deposits and implement strategies with modular, auditable code. Yearn’s allocator vaults, Morpho’s lending vaults now powering Coinbase Loans on Base, Euler’s vault kit, and Veda’s infra toolkit all fit this pattern.

- Risk curators sit beside or on top, constantly measuring and tuning. Gauntlet bands the risk, Steakhouse and Re7 curate per-market vaults, and Chaos Labs automates parameter changes for blue-chips like Aave, all of them pushing the space toward programmable risk layers.

- Users interact with vault protocols as a means to obtain capital for their own purposes. These range from personal needs in the case of retail borrowers, to more specific market functions such as market making in the case of some dedicated firms. In practice, users deposit via protocol UIs, wallets, or fintech apps into vaults where allocator capital provides depth, tighter spreads, and faster exits, or they borrow against allocator-supplied pools as is the case for crypto-backed loans.

Mapping the Future of Vault-Based Finance

In a short amount of time, vaults have gone from clever wrappers to programmable financial infrastructure. ERC-4626 standardized the plumbing, vault protocols industrialized strategy execution, and professional curators made risk an explicit, managed layer rather than an implicit hope. The result is an ecosystem that looks less like a collection of dApps and more like an operating system for onchain capital.

Two forward-looking themes to watch:

- Vaults as distribution. Many call this the DeFi mullet thesis where more CEX and CeFi players will act as distribution for vaults. We’re already seeing mainstream distribution of vault-native experiences such as Coinbase’s Loans powered by Morpho. As infrastructure like Veda matures, more wallets, fintechs, and exchanges will ship branded “earn” products on top of ERC-4626 vaults that are abstracted, audited, cross-chain.

- Programmable risk layers. The next competitive frontier is not “who has the highest APY,” but who manages risk most credibly. Curator marketplaces like Gauntlet and Steakhouse point toward a world where there is a risk curve and an inverse relationship between risk and reward. Gauntlet’s different vaults already offer an example where the more exotic vaults have higher risk and higher yield, whilst prime has lower risk and lower yield. This is a world where tokenized risk primitives such as Cork become crucial.

Vaults are no longer islands. They’re the connective tissue between capital, code, and risk. We can see them as an infrastructure layer quietly powering how DeFi earns, borrows, hedges, and scales. If the last few years were about inventing vaults, the next few are about routing the world’s balance sheets through them.

Read more about onchain vaults:

- Demystifying Onchain Vaults and the ERC-4626 Token Standard

- The Evolution of Onchain Vaults: From Aggregators to Curated Yield

If you’re curious about risk tokenization in particular, dive deeper into the concept and jump into the Cork docs or contact us if you’d like to learn more about how it can help your company. You can also subscribe to the Cork Newsletter for regular updates on Cork’s role in the future of onchain vaults.

Follow Cork on X or LinkedIn and join the community on Discord.

.png)