.jpg)

The Evolution of Onchain Vaults: From Aggregators to Curated Yield Infrastructure

August 2025

8 mins read

Vaults have quietly become one of DeFi’s crucial building blocks. They emerged during DeFi Summer in 2020 as a breakthrough that made high-yield strategies accessible to users without their manual intervention.

In 2022, the ERC‑4626 for tokenized vaults transformed them into composable financial primitives. With standardized interfaces, vaults became plug-and-play yield instruments that paved the way for vault interoperability and modular infrastructure.

Today, vaults can be understood as programmable yield machines. We’ve progressed from fragmented deposit strategies to a modular, curated ecosystem powering billions in TVL across blockchains.

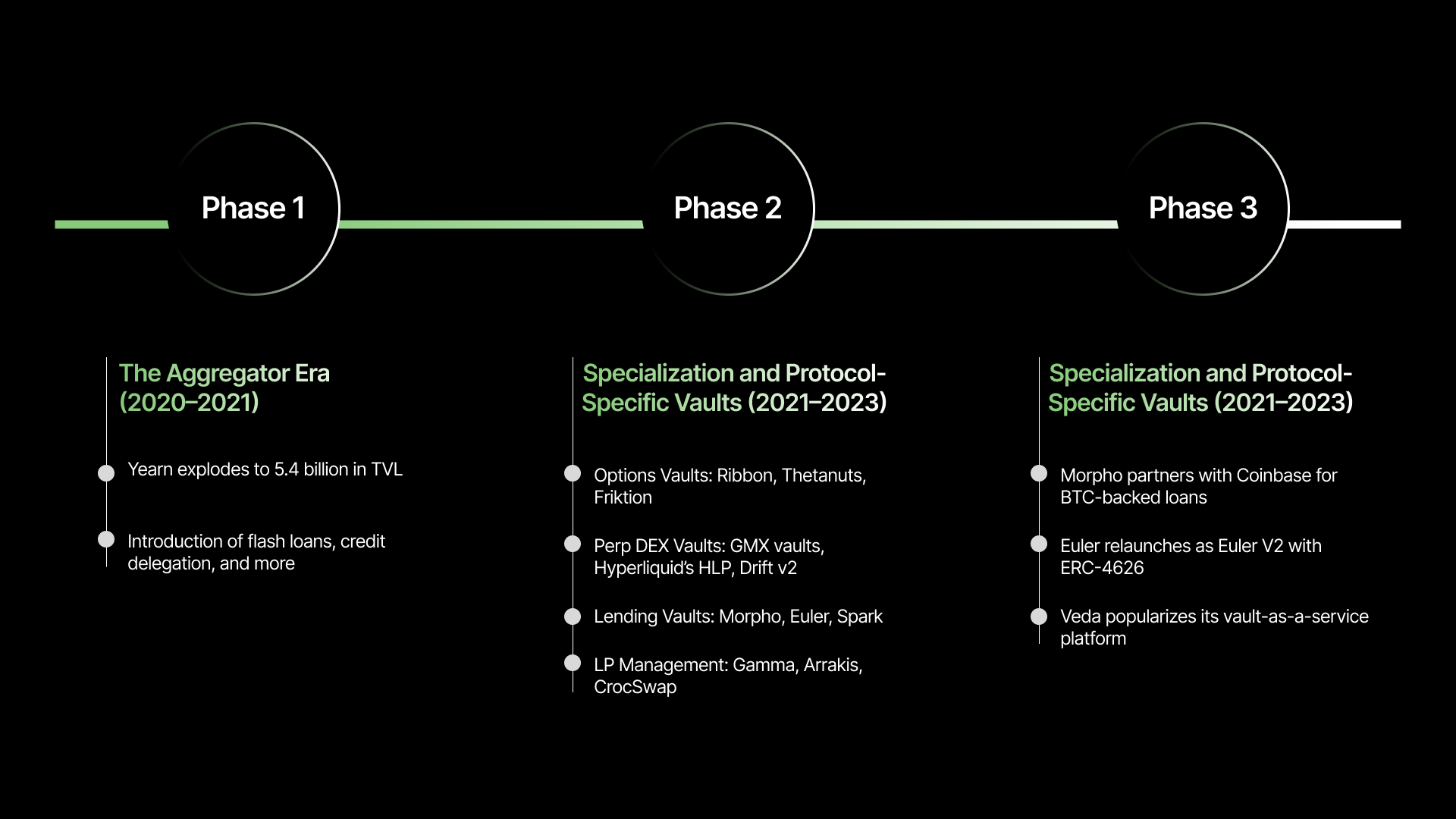

The vault evolution can be understood in three phases: the emergence of yield aggregators, the rise of protocol-specific strategies, and the development of standardized, curated vault infrastructure designed for composability and institutional scale. This post traces that evolution.

Phase 1: The Aggregator Era (2020–2021)

Vaults first gained traction with Yearn Finance in 2020. Early vaults served as yield aggregators, reallocating user capital across protocols like Aave, Compound, Curve, and Uniswap.

At the time, these protocols were introducing features such as flash loans, credit delegation, isolated lending markets, isolated single-asset lending markets, and cross-chain support which facilitated such strategies. For users, it meant depositing assets like DAI or USDC once, while the vault automatically switched strategies to optimize returns and minimize gas fees.

These vaults primarily acted as wrappers over existing DeFi protocols. Yield came from external sources such as lending interest or liquidity mining incentives, and vault upgrades were handled by governance or multisigs. Importantly, these vaults issued ERC-20 tokens to represent user shares, setting the foundation for future vault standards.

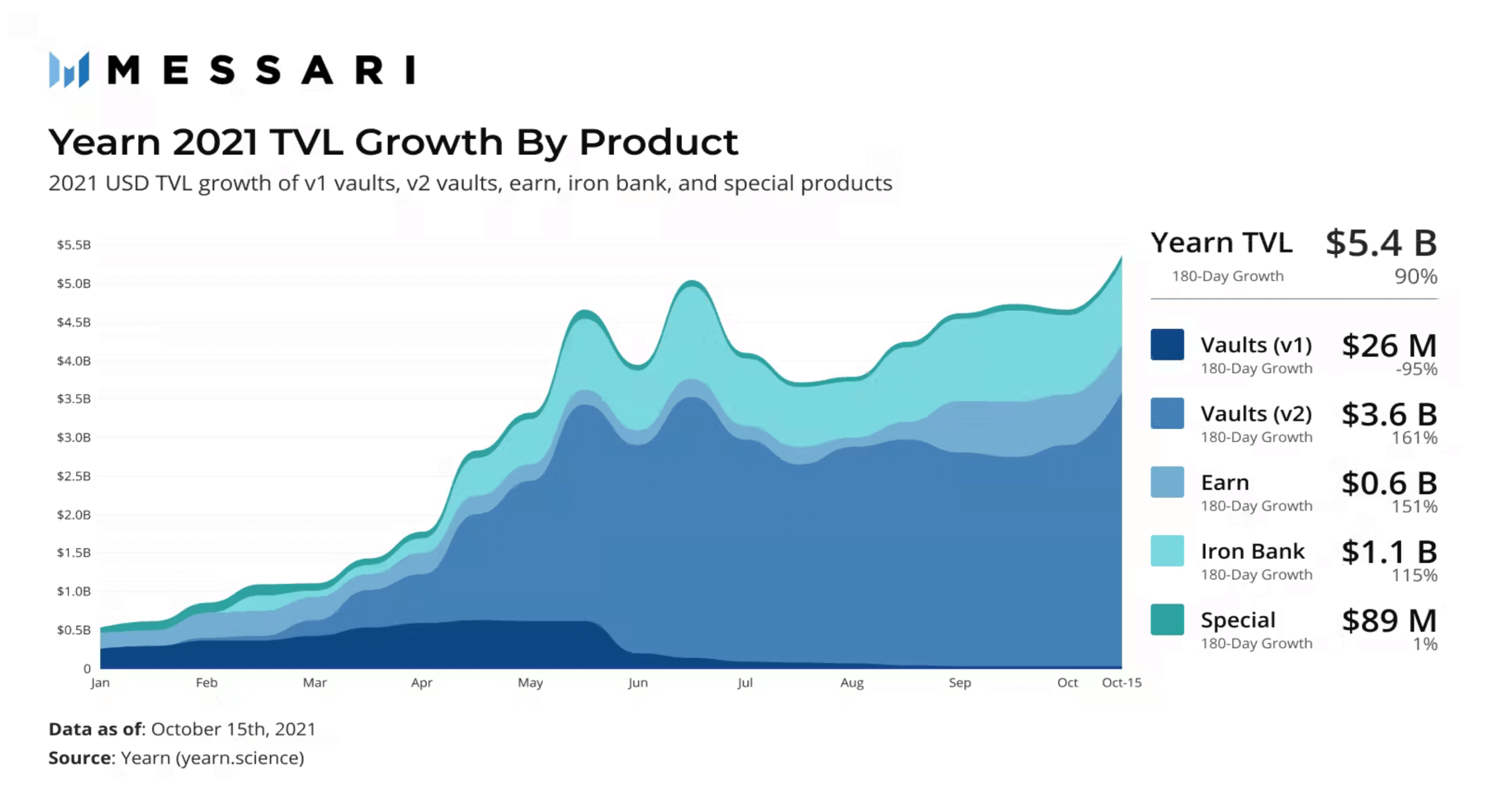

Yearn's model proved highly scalable. By October 2021, it had reached over $5.4 billion in TVL and introduced a new paradigm for passive DeFi participation.

Phase 2: Specialization and Protocol-Specific Vaults (2021–2023)

As DeFi protocols matured, vaults began evolving into specialized, strategy-specific infrastructure tailored to their yield source, native strategies, and user bases:

Options protocols like Ribbon and Thetanuts launched a new category of vaults that generated income by automatically selling covered calls and puts. These strategies, long used in traditional finance, became accessible to retail users onchain through simple vault interfaces. Users could deposit ETH or other assets and passively earn yield via options premiums, without managing complex positions themselves.

Perpetual futures exchanges such as GMX and Hyperliquid introduced vaults that played a critical role in powering liquidity provision. Products like Hyperliquid's HLP abstract away the mechanics of market-making on perpetual DEXs, allowing users to deposit capital into a shared pool that algorithmically provides liquidity to traders. These vaults earn fees and funding rate spreads, effectively making depositors passive market makers.

Vault-native lending markets through protocols like Morpho, Euler, and Spark that moved beyond the pool-based systems of Aave and Compound. These vaults handle risk, interest rate logic, and loan parameters within isolated, smart-contract-contained systems. Vault-based lending also opened up the possibility for curated risk profiles and permissionless market launches, laying the groundwork for more modular financial design.

Automated LP position management came to the fore with protocols such as Arrakis and Gamma which tackled the challenge of liquidity provisioning on automated market makers (AMMs) through vaults. These vaults dynamically rebalance and hedge positions, optimize fee income, and minimize impermanent loss. For LPs, this meant smarter exposure to DeFi trading volume without needing to actively manage liquidity ranges or rebalance positions manually.

Real-World Asset (RWA) vaults also became pivotal in tokenizing real-world credit, via platforms like Goldfinch, Maple Finance, and Centrifuge. These vaults lend to real-world borrowers and distribute onchain yield. This became part of an ongoing trend where vaults are able to connect DeFi with TradFi.

Together, these specialized vaults enabled a wide spectrum of DeFi strategies to be abstracted into passive, composable primitives. However, the lack of a unified vault standard led to fragmentation. Each vault had its own custom logic, and without a shared interface, building integrations or general-purpose tooling was difficult. This bottleneck set the stage for ERC-4626.

Phase 3: The Curated Vault Era (2023–2025)

The introduction of ERC-4626 in 2022 was a turning point. It provided a standard interface for tokenized vaults, defining how they handle deposits, withdrawals, and accounting. With this standardization, vaults became composable “DeFi legos” that could interact seamlessly across protocols and ecosystems.

This laid the foundation for the curated vault era, marked by three major projects: Morpho, Euler V2, and Veda.

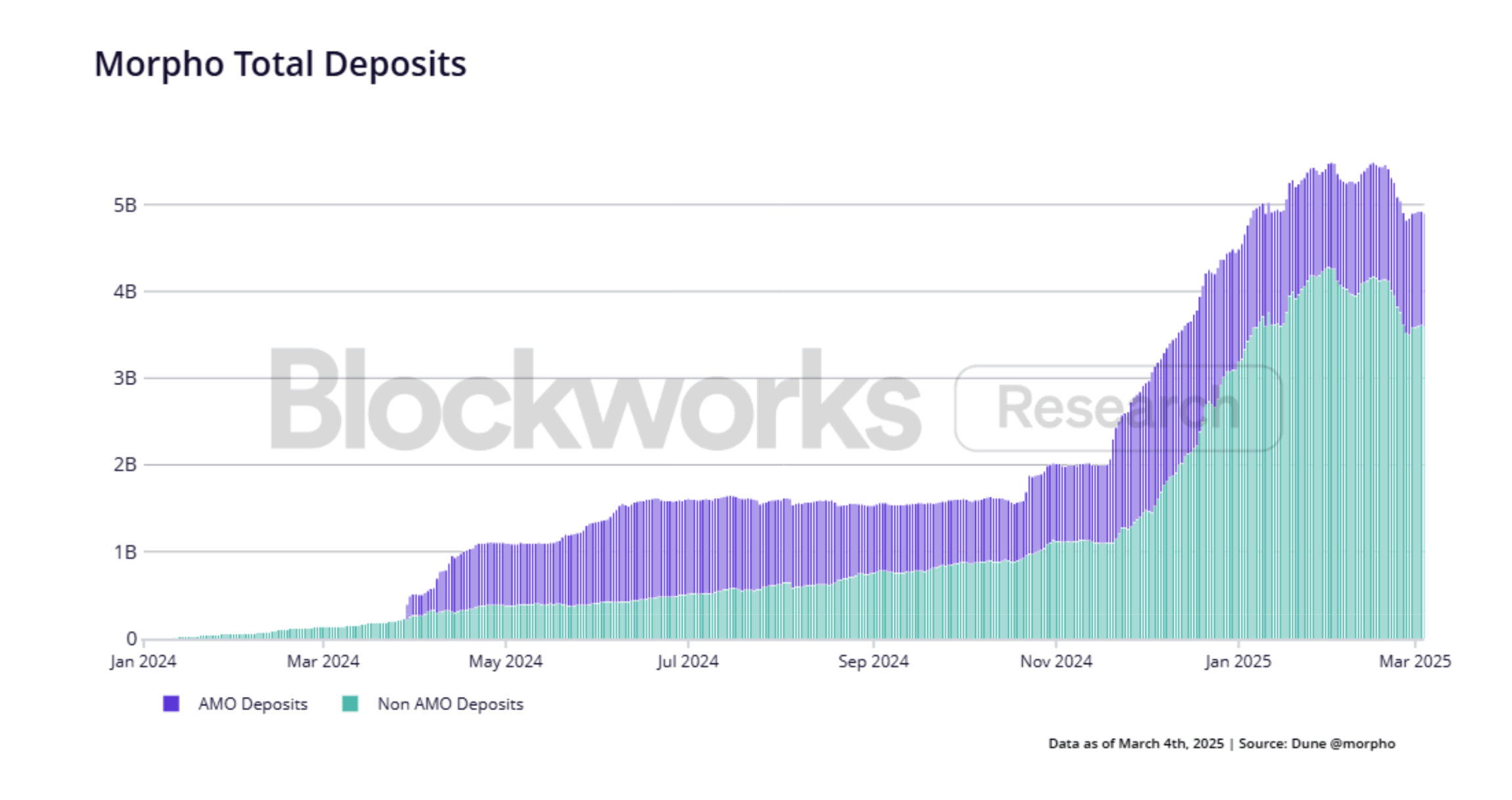

Morpho redefined lending by introducing aggregated vaults that match lenders and borrowers peer-to-peer when possible, falling back to underlying pools like Aave when needed. Each asset can support multiple vaults, curated by different managers for specific risk-return profiles. By mid-2025, Morpho surpassed $5 billion in TVL and partnered with Coinbase to power BTC-backed loans on Base.

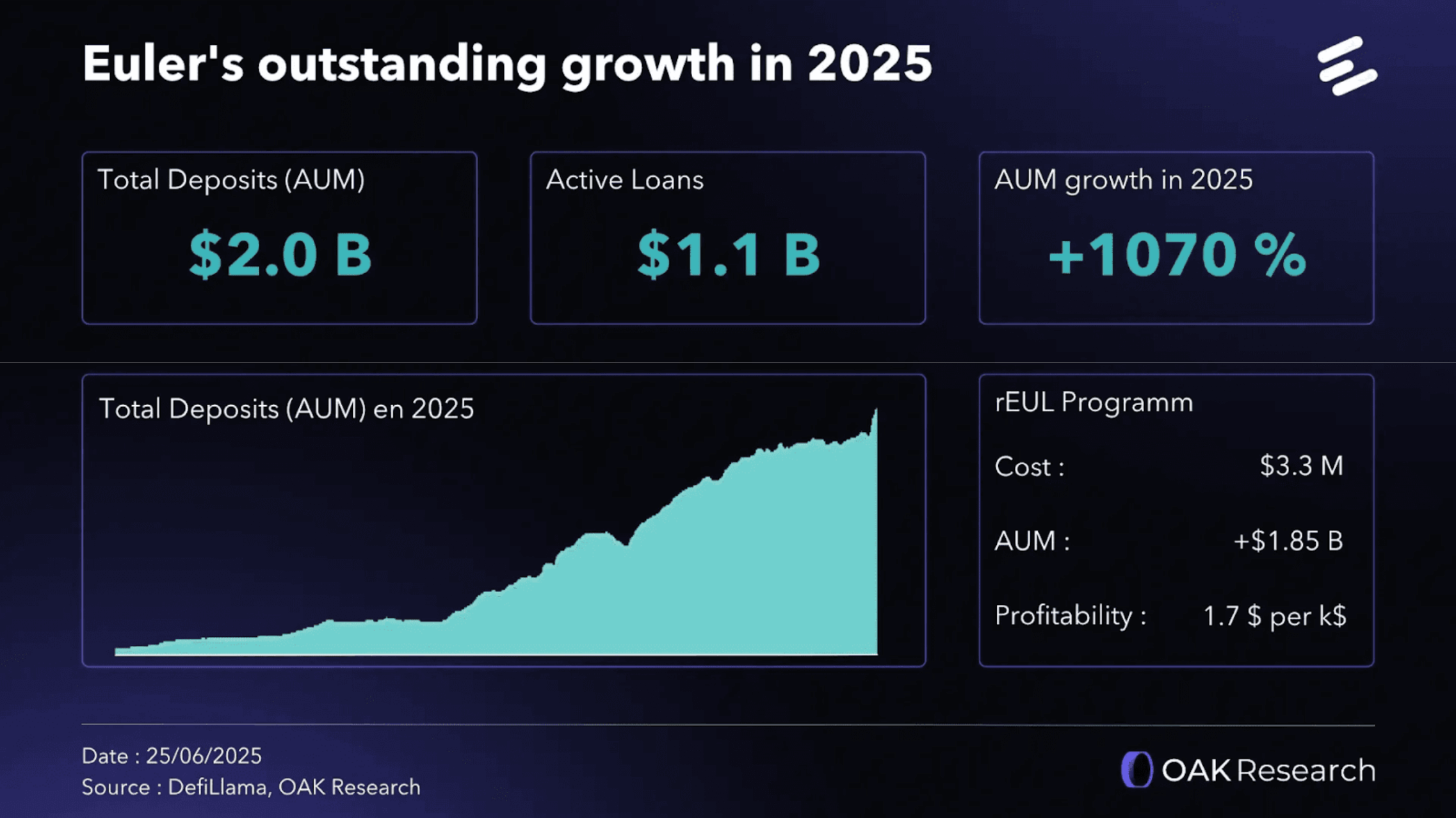

Euler relaunched in late 2024 with a vault-per-asset model, where every token has its own ERC-4626-compliant vault. Vaults can be deployed permissionlessly and configured with customized interest rate models, liquidation rules, and oracle sources. Some vaults are fully autonomous, others are curated by DAOs or risk managers like Gauntlet. Euler V2 quickly grew to over $2 billion in TVL by mid-2025.

Veda emerged as a vault-as-a-service platform, enabling anyone to create structured yield vaults with minimal development overhead. Building on an idea first introduced by Enzyme, it offers a standardized vault framework across chains, abstracting away development complexity.

This framework makes it easy to spin up such vaults for “any DeFi use case” while preserving self-custody, transparency, and control for users. One way to think about it is “Productized DeFi” through curated vault offerings. Instead of a user having to navigate dozens of protocols, an app could use Veda to offer a menu of yield vaults tailored to different profiles. Platforms, wallets, and DAOs can plug in curated vaults like ready-made yield products, much like Stripe enables payments.

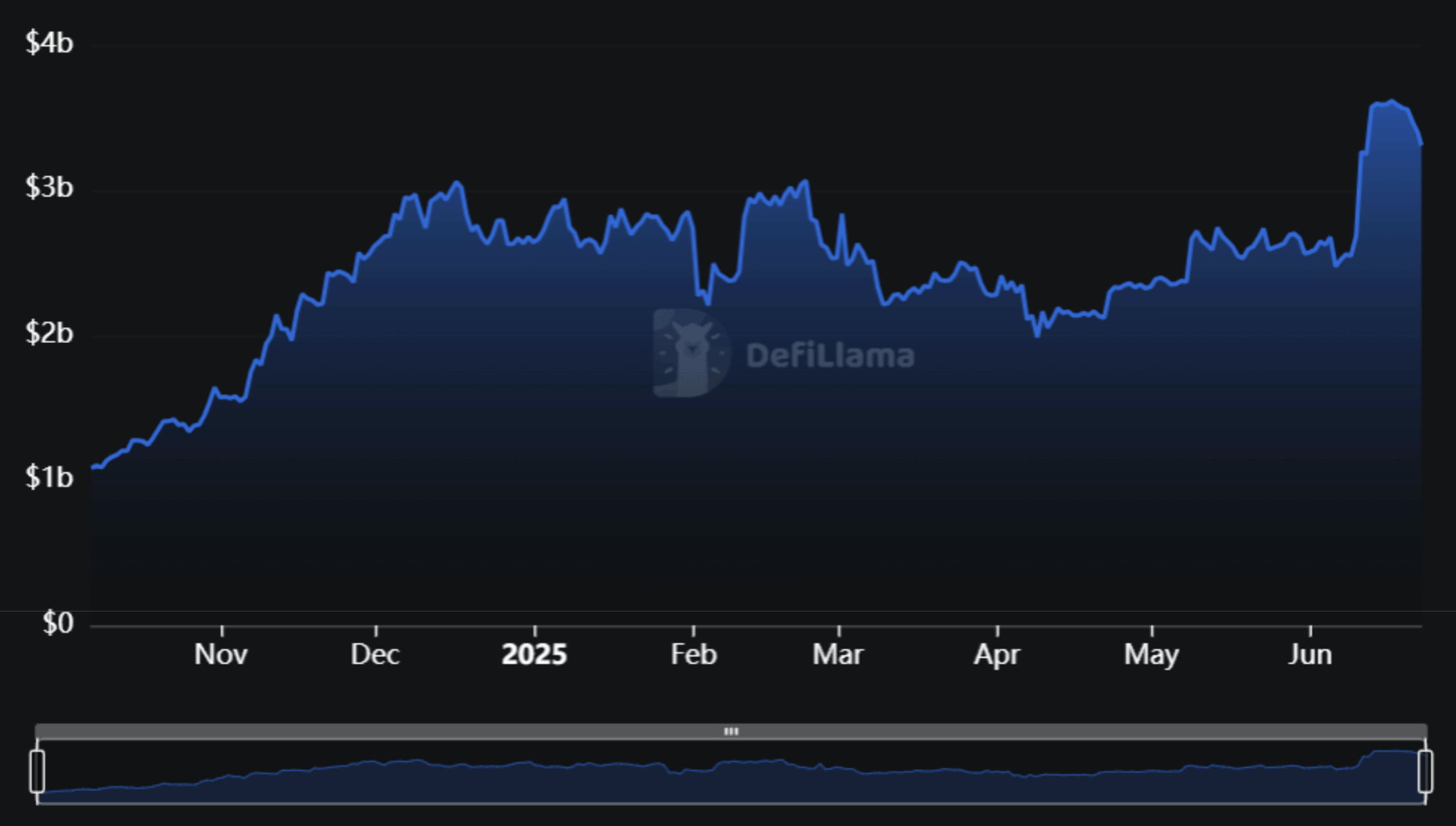

A year after launching, Veda grew to over $3 billion TVL and 100,000 users. It currently sits at $4.4 billion and supports a spectrum of vaults that range from conservative stablecoin savings vaults to high-yield “degen” strategies deployed across Ethereum, L2s, and other ecosystems.

Key Trends Driving Vault Innovation

Across these phases and experiments, a few common themes emerge that are driving the next generation of vaults. Some of the powerful trends defining the current vault landscape we can see are:

- Curated Strategies: Vaults are now designed or overseen by experts like Steakhouse and Gauntlet, offering different risk-return profiles, much like mutual fund managers. Instead of users aping into ad-hoc strategies, they can now pick a vault curated by a reputable team that aligns with their goals. The vault curator model pioneered by Morpho and Euler is likely to expand in the near future.

- Modularity: Vaults are increasingly used as modular building blocks rather than monolithic contracts. They can be stacked, plugged in or tailored via templates. Permissionless vault creation and their integration by other protocols is a part of this trend. The endgame is a “vault Legos” ecosystem, where customizable vault templates can be mixed and matched to build new financial products quickly.

- Permissionless Market Creation: The ethos of DeFi – open access – is manifesting in vaults through permissionless launchpads. Anyone can launch a vault or lending market now. This dramatically lowers the barrier to innovation: if you have a novel idea for a yield strategy or a credit market, you can deploy it as a vault without needing to bootstrap an entire protocol and token. Of course, with that comes the need for discoverability and risk assessment.

- Cross-Chain Expansion: Vaults are deployed across Ethereum, L2s, Solana, and Cosmos. With ERC‑4626 compatibility, vaults can operate across different L2s with similar interfaces. Morpho’s TVL on Base is already $1.6B, for example. Vaults will also become chain-agnostic yield products as bridging tech improves, making them accessible from any network beyond their main L1.

Vaults as the New Default in DeFi Infrastructure

Vaults have matured from manual wrappers over lending pools into flexible, programmable financial primitives. Vaults now serve as both interface and infrastructure—users interact with yield through vault tokens, and protocols use vaults to manage liquidity and credit.

ERC‑4626 played a central role, enabling this transformation by standardizing vault behavior and unlocking composability. With innovations like curated strategies, modular vault frameworks, permissionless market creation, and cross-chain deployment, vaults are reshaping DeFi. Just as ERC‑20 defines how tokens move and integrate, ERC‑4626 and vault design define how yield and risk move in DeFi.

Looking ahead, expect vault-based risk tokenization, validator-backed vaults, and more institutional vault offerings. The design of vaults will continue to evolve, but one thing is clear: vaults are now the heart of DeFi, and any growth in lending, yield, or capital efficiency will be built on vault primitives.

Read more about onchain vaults:

If you’re curious about risk tokenization in particular, dive deeper into the concept and jump into the Cork docs or contact us if you’d like to learn more about how it can help your company.

Follow Cork on X or LinkedIn and join the community on Discord.

.png)