Demystifying Onchain Vaults and the ERC-4626 Token Standard

August 2025

8 mins read

Vaults are the unsung heroes of DeFi. When people think of DeFi they likely think of lending protocols, AMMs, and staking systems. However, vaults are typically closer to what everyday users experience as the more streamlined experience for DeFi since they abstract away all the manual steps and technical learning curve that come with most of these applications.

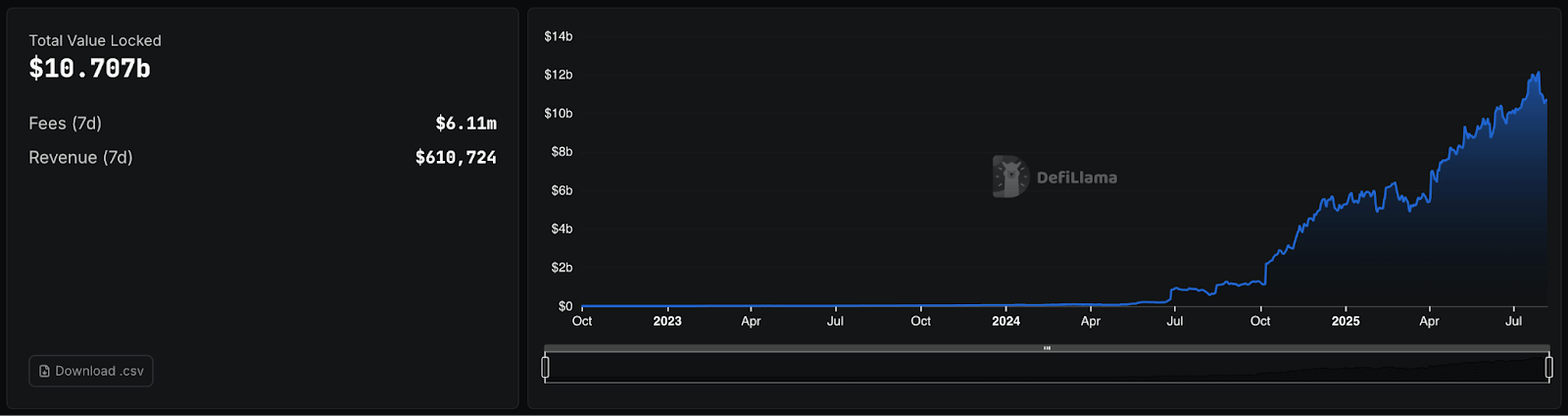

Onchain vaults already represent a massive portion of DeFi infrastructure, collectively holding north of $10 billion dollars in TVL thanks to standardization efforts like ERC‑4626. As vault standardization continues to mature, the onchain vault sector is increasingly positioned to attract institutional and TradFi capital.

With consistent behavior, auditability, and composability, ERC‑4626 vaults provide the infrastructure primitives necessary for scaling yield strategies at institutional volumes. If adoption continues and DeFi infrastructure integrates seamlessly with traditional finance channels, it’s realistic to envision trillions of dollars from traditional finance capital flowing into onchain vaults in the coming years, according to Veda CEO Sun Raghupathi.

This post will walk you through what vaults are, why they matter, and how ERC-4626 is transforming the way DeFi handles yield.

What Are Onchain Vaults, Exactly?

At their core, onchain vaults are smart contracts that manage pooled assets and execute yield strategies on behalf of users. When a user deposits tokens into a vault, they receive “vault shares” in return. These shares are simply ERC-20 tokens that represent a proportional claim on the vault’s total assets. As the vault earns yield (through lending, staking, liquidity provision, etc.), the value of each share increases.

In essence, vaults are automated investment vehicles that abstract away the complexity of DeFi strategies. You put your assets in, and the vault does the rest. It takes care of compounding rewards, reallocating capital, and managing gas costs.

Why Do People Use Onchain Vaults?

Vaults are interesting to different kinds of market participants, mainly liquidity providers, asset issuers, and risk curators. Each of these finds the onchain vault mechanism particularly useful in their own way.

Regular users, or liquidity providers, leverage vaults to passively earn yield without micromanaging every protocol or gas fee. Instead of chasing APYs manually, the vault’s risk curators do the hunting and compounding on behalf of the users. The ability to structure this type of activity in a vault, democratizes the access to actively managed yield sources. They don't need to be an accredited investor to enter a curated vault on Veda or Morpho, as opposed to a hedge fund.

On the other hand, protocols, or asset issuers, use vaults to offer sustainable, strategy-based yield that doesn’t rely on inflationary token emissions. This allows them to manage protocol treasuries more effectively and create modular, composable products using vaults as building blocks.

Risk curators and strategists also benefit by designing and deploying sophisticated vault strategies tailored to specific risk profiles. This allows them to offer a single “bucket” where their expertise and market insight can serve everyday DeFi users who wish to delegate their funds to experienced market participants according to their risk appetite. Curators actively manage funds, similar to managed capital in a hedge fund, and as a result drive capital towards places with highest risk adjusted yields and where capital is needed in the ecosystem.

Altogether, this creates capital efficiency at scale while abstracting away complex DeFi interactions.

How Onchain Vaults Work

At a basic level, an onchain vault automates DeFi yield by pooling user deposits in a smart contract that executes a predefined strategy (e.g. lend USDC, stake ETH). Then it compounds rewards and returns that yield to depositors. Under the hood, the vault contract is tracking total assets (how much is held or deployed), total shares (how many vault tokens are in circulation), and share price (the value of each share as yield accrues).

For users, interacting with vaults is as simple as:

- Finding a vault (e.g., USDC vault on Euler or Morpho)

- Depositing their token (e.g., 1,000 USDC)

- Receiving vault shares (e.g., 964 MWUSDC)

- Waiting for yield to accrue (e.g., via lending or staking)

- Withdrawing when ready (vault shares are now worth 1,050 USDC)

They don’t need to manage strategy, rebalance, or compound manually since the vault does that for them.

Problem: Historical Fragmentation in Onchain Vault Design

When onchain vaults first became popular during DeFi summer in 2020, every vault protocol built its own implementation. This led to certain challenges for their implementation that ultimately created pain points for users.

Onchain vaults had inconsistent interfaces across protocols with custom integrations required for each vault. Each vault had its own functions, withdrawal mechanism, internal math, and required custom integrations. This limited composability between vaults and DeFi primitives, making it hard for applications like aggregators or wallets to support every vault type. It was difficult to build generalized tooling for yield strategies, and this ultimately affected user experience.

Solution: ERC-4626 — The Onchain Vault Token Standard

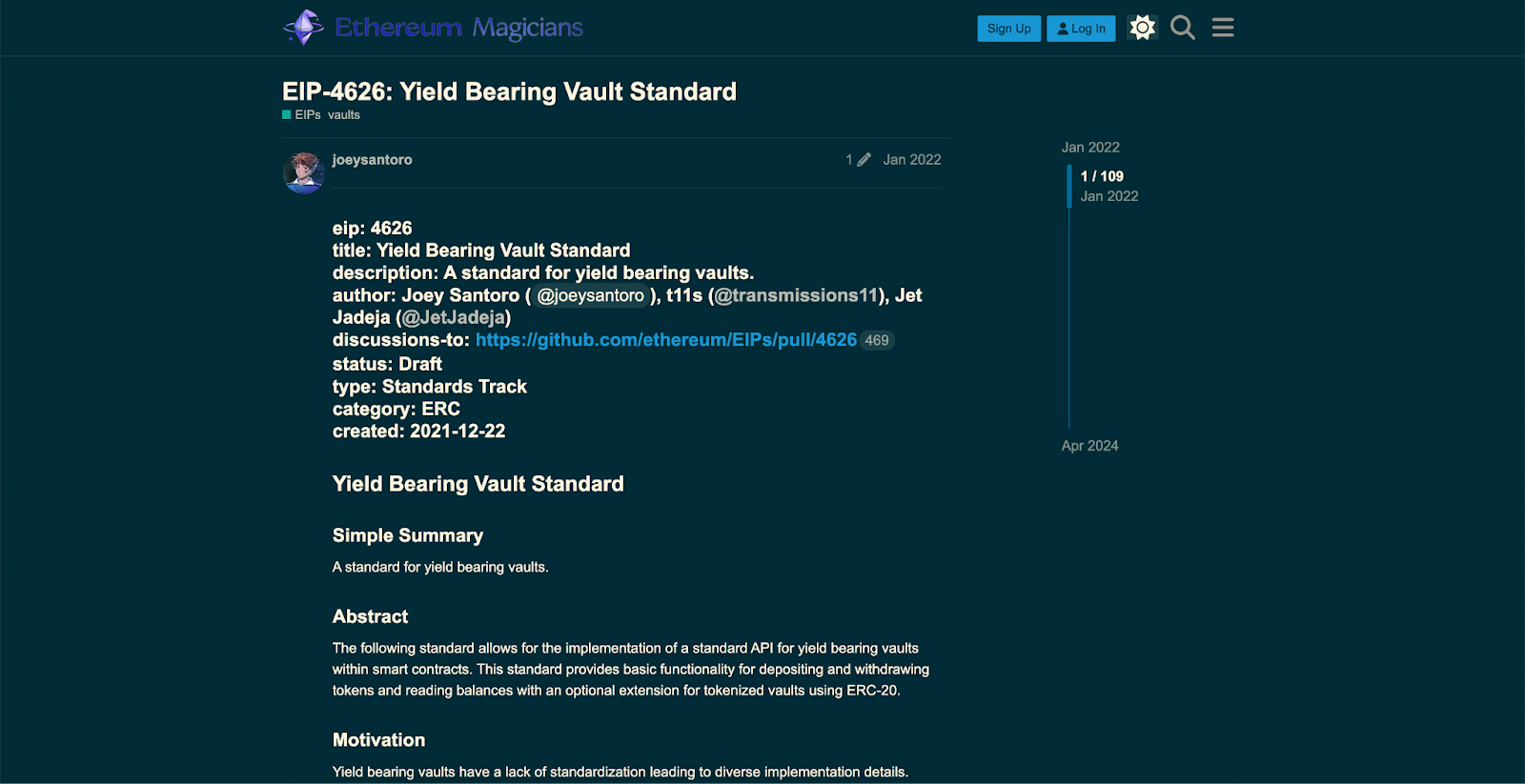

DeFi needed a shared language for vaults, one that could standardize how deposits, withdrawals, and accounting worked across protocols. The solution was ERC-4626.

In 2022, the Ethereum community developed a token standard designed to make vaults plug-and-play. ERC-4626 defines a universal interface for onchain vaults that wrap a single ERC-20 token. It standardizes how users and contracts interact with yield-bearing vaults.

Key Features of ERC-4626

- Standardized interface: Every vault supports deposit(), withdraw(), mint(), and redeem() functions.

- Share accounting: Vaults issue shares under the widely-adopted ERC-20 token standard and represent shares proportional to deposits. As yield accrues, each share represents more underlying tokens.

- ERC-20 compatibility: Vault tokens themselves behave like any ERC-20 token. They can be transferred, used as collateral, and integrated into DeFi apps.

Benefits of ERC-4626

ERC-4626 brings significant improvements to the DeFi ecosystem by standardizing how yield-bearing vaults are implemented, interacted with, and integrated.

For developers, this means plug-and-play compatibility with wallets, aggregators, and other DeFi protocols. They have no need to write custom adapters for each vault implementation. The predictable, standardized interface also makes contracts easier to audit and secure, reducing the likelihood of bugs or integration failures.

For protocols building on top of vaults, such as yield optimizers, structured products, or risk management layers, ERC-4626 unlocks powerful composability. Vaults can now be stacked, reused, or abstracted across ecosystems with minimal friction. The standard also enables greater scalability, as protocols can rapidly deploy new vaults using proven frameworks without reinventing the wheel each time. In short, ERC-4626 is a foundational step toward a more modular, secure, and scalable DeFi landscape.

Finally, users benefit from a more consistent and intuitive experience. Since all ERC-4626 vaults follow the same rules for deposits, withdrawals, and share accounting, users no longer have to learn the quirks of each protocol and have a clear view of what they own directly from their wallet. This consistency not only improves UX but also reduces the risk of interacting with unfamiliar or non-standard vaults, making DeFi safer and more accessible.

The Future of ERC-4626 and Onchain Vaults

Onchain vaults are being shaped by a wave of innovation that builds on the foundation ERC-4626 provides. The token standard is serving as a launchpad for the next generation of composable onchain finance.

At the infrastructure level, modular vault frameworks are accelerating time-to-market for new strategies. Platforms like Enzyme, Veda, and Factor are enabling builders to deploy and manage vaults using standardized components, reducing development overhead while increasing security and flexibility. And as the ecosystem expands, interoperability with Autonomous Verifiable Service(AVSs) such as EigenLayer and Symbiotic is becoming more relevant.

One major trend is the rise of vault-based structured products. Thanks to the composability and standardization of ERC-4626, protocols can now offer more complex financial instruments like options vaults, principal-protected strategies, and tranching mechanisms—all within a consistent vault framework that users and developers already understand.

Another powerful development is the emergence of composable risk layers. Projects like Cork are introducing the concept of risk tokenization and creating a programmable risk layer. This can act as a hedging tool and a liquidity buffer on top of ERC-4626 vaults. It effectively transforms vaults from passive yield containers into programmable financial instruments that can hedge, insure, or even transfer risk in dynamic ways.

Why Onchain Vaults and ERC-4626 Matter

Onchain vaults are financial engines in DeFi that power yield, automate strategy, and maximize capital efficiency. For a while, they were fragmented and difficult to compose and ERC-4626 changed that. By creating a universal interface for tokenized vaults, it unlocked a new wave of innovation in yield products, portfolio management, and DeFi infrastructure.

Now vaults that are easier to integrate, safer to use, and more powerful than ever. More importantly, they’re making way for a more mature DeFi landscape that introduces concepts like structured products and risk tokenization, letting risk curators, protocols, and liquidity providers have a larger toolset.

If you’re curious about risk tokenization in particular, dive deeper into the concept and jump into the Cork docs or contact us if you’d like to learn more about how it can help your company. You can also subscribe to the Cork Newsletter for regular updates on Cork’s role in the future of onchain vaults.

Follow Cork on X or LinkedIn and join the community on Discord.

.png)