.png)

Introducing Protected Loops

December 2025

5 mins

Today we are introducing Protected Loops, a new primitive that opens looping strategies to new markets and acts as an institutional liquidity backstop.

Protected Loops make it possible to safely scale leverage into long-duration assets without exposing liquidators or lending markets to duration risk. The result is a looping vault with a built-in emergency liquidity hatch, designed for both stability and capital efficiency.

.png)

Who Needs Protected Loops?

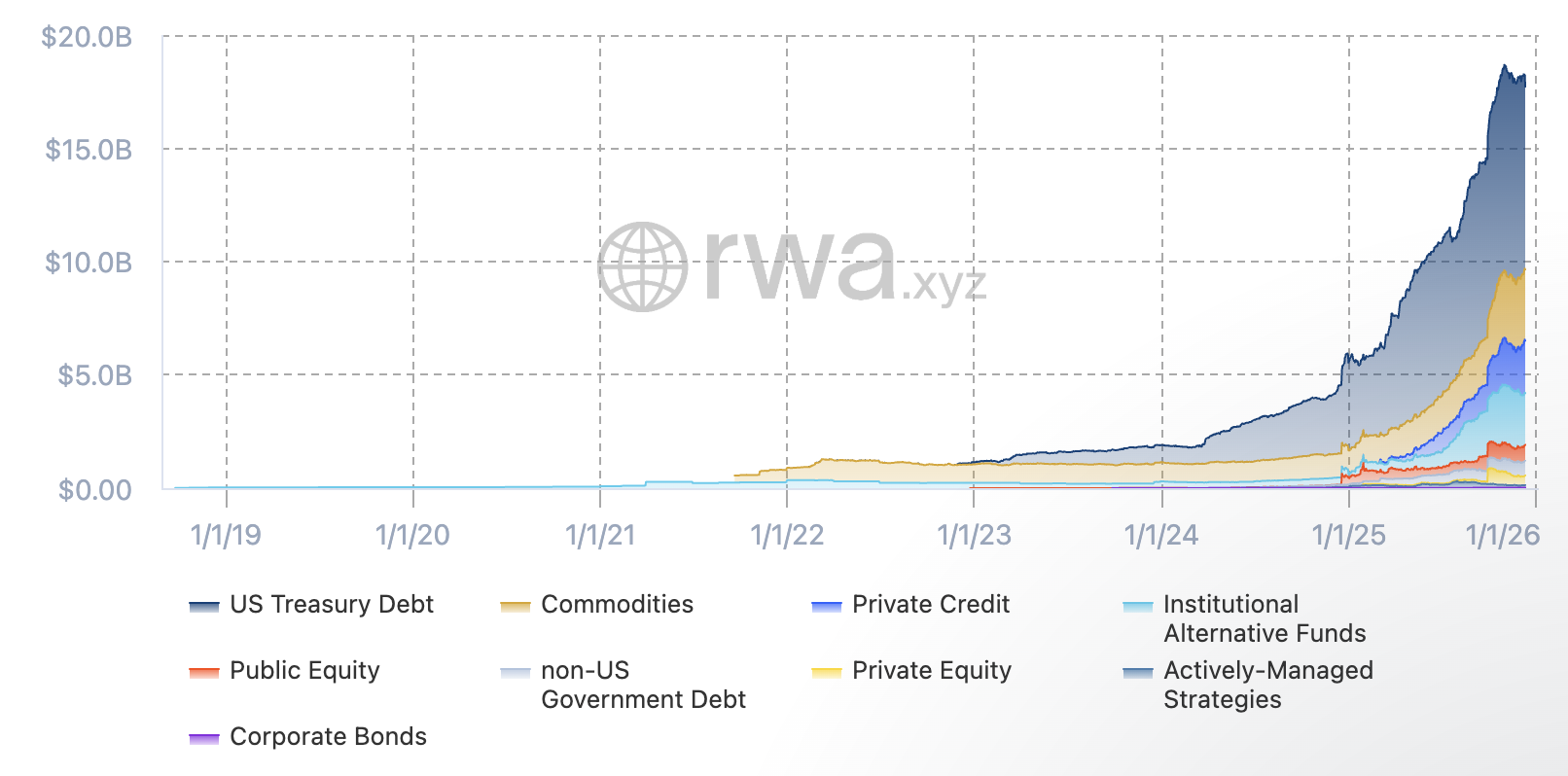

Real World Assets (RWAs) and vaults have become major sources of onchain yield, with RWAs alone scaling from $4b to $18b of TVL in a year.

The problem is that most assets cannot participate in lending markets because they are illiquid or long-duration (RWAs & yield vault tokens such as Apollo’s ACRED or Fasanara’s mF-ONE), making them difficult to liquidate safely, and unsupported by traditional liquidators who can’t hold multi-week or long-tail risk.

What Are Protected Loops?

Protected Loops are a new DeFi primitive that unlock the ability for yield bearing assets with long-duration or illiquidity to tap into looping. They unlock lending markets to tap into the new and fast-growing market of RWAs, specifically long-term duration RWAs, as well as vault tokens and novel illiquid synthetic dollars.

At their core, Protected Loops shift duration risk away from the Looping Vault and lenders and onto Cork underwriters. The primitive combines a managed Looping Vault with an embedded liquidity hedge via Cork Pools. In this model:

- An operator is managing a vault, which will execute a dedicated looping strategy using a yield bearing collateral asset, hereafter referred to as $RWA.

- A Cork Pool is configured that incorporates $RWA as a Reference Asset, paired against a liquid Collateral Asset.

- Underwriters then mint Swap Tokens in this Cork Pool, which are sold directly to the Looping Vault.

.png)

This means the operator can exercise the Swap Token + $RWA at any time to pull out liquid collateral assets, for example sUSDS, if there is a need to unwind or liquidate the trade. Furthermore, the Looping Vault plays the liquidator role in the lending market because it can atomically perform liquidations if needed through the Cork Pool, with liquidation penalties being reabsorbed by the Looping Vault.

New Paradigm of Looping

Protected Loops introduces several new attributes to DeFi:

- The design unlocks onboarding and scaling of major new asset classes through looping trades, in particular long-duration RWAs and vault tokens.

- Creates instant liquidity for the looped collateral. Meanwhile, it supports simplified lending market liquidations to protect lenders.

- As a novel primitive, Protected Loops will serve as a new yield bearing instrument in DeFi that opens access to lending market rate arbitrage.

Expand to New Markets with Protected Loops

Protected Loops enable illiquid, long-duration RWAs to scale to multi-trillion-dollar levels over time and catalyze meaningful DeFi growth. Likewise, they can provide the liquidity backstop that the market needs as it continues to receive an inflow of institutional capital.

Protected Loops are currently in a pilot phase. The configuration being piloted is scalable and repeatable across various asset categories, vault designs and lending markets. Over the coming months Cork will showcase a range of Protected Loops in production and is excited to replicate and scale the design to enable stable and risk-managed growth of the DeFi ecosystem.

If you are an asset issuer, curator, lending market or vault that would like to take advantage of Protected Loops to scale, please contact us.

.png)