.png)

Ethereum: The Internet Debt Machine

July 2025

10 mins read

As I'm reflecting on Ethereum's 10th anniversary, I thought I'd share my perspective on the current state of Ethereum, where I see product-market fit, and where I see problems.

Ethereum is evolving into the Internet Debt Machine.

That might sound overly reductive description of a network that initially set out to become the "World Computer" and has no shortage of other activity beyond just lending. But I would contend that the opportunity for global debt capital markets on Ethereum dwarfs everything else. The killer use case is onchain debt.

During 2021, I was working on the corporate bond desk at Goldman Sachs when we issued debt for the European Investment Bank on Ethereum. This was the first ever bond deal done on a public blockchain, and it was the lightbulb moment for me personally where I realized that Ethereum was a 100X improvement over the legacy infrastructure. Now the market is warming up to the same conclusion.

Internet Debt Markets

Over the last 18 months, onchain debt has grown dramatically. Stablecoin supply has more than doubled from $130bn to $260bn+. DeFi TVL is approaching $200bn, with Ethereum L1 accounting for nearly two-thirds of that. Tokenized private credit is on the rise, with RWAs reaching $8bn of supply on Eth. L1. And DeFi lending has eaten CeFi lending's lunch.

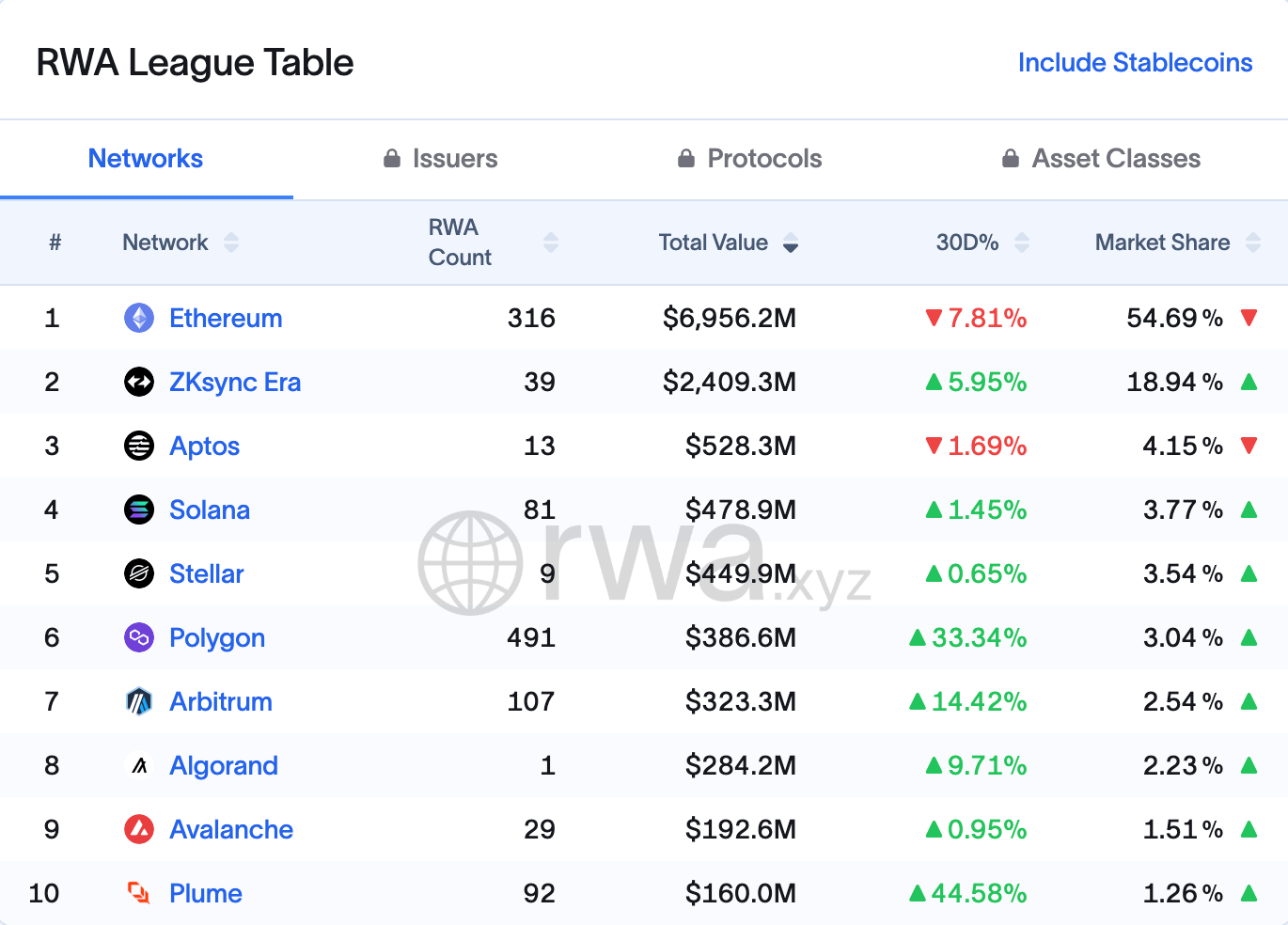

Stablecoins are the foundation here, and Eth. L1 owns ~55% market share today. Fundamentally, stables are short-term debt instruments. They’re also the entry point for other RWAs, especially offchain / private credit to come onchain. Eth. L1 also owns ~55% market share of RWAs, and if you include L2s it has ~80% market share.

Speaking of the RWA market, let's take a look at some of the institutions who are currently participating in the onchain debt ecosystem on Ethereum:

- Blackrock

- JP Morgan

- Franklin Templeton

- Fidelity

- Apollo

- Janus Henderson

- Cantor Fitzgerald

- Guggenheim

- WisdomTree

- PayPal

- VanEck

In my mind, this is more evidence of clear product-market fit, and I don't see how any rational actor could be betting against the trend of institutional adoption—particularly now that the GENIUS Act has been signed into US law and the CLARITY Act has passed the House.

Why Ethereum?

Ethereum has long prioritized security & decentralization, even at the expense of performance. This tradeoff has made Eth L1 ideal for high-trust, low(er)-velocity financial infrastructure (i.e. tokenized debt & lending markets). This has allowed Ethereum's debt markets to become the deepest capital markets anywhere onchain.

Yield-seeking capital is sticky. It wants to be productive, it prioritizes security, and doesn't really care about UX. Large capital allocators are biased towards infrastructure that is the most battle tested. They don't really mind that Ethereum feels a bit clunky. For debt markets, lindyness is more important than throughput.

What About Equity Markets?

In terms of onchain venues, Solana and Hyperliquid are the most notable, as their high-throughput architecture and slick UX allow for high-velocity, retail-driven trading. But CeFi still dominates here (check Binance's market share... the king is still the king).

And in terms of TradFi adoption, it's actually less effecient to trade stocks onchain, because the infrastructure is already relatively good. Sure, we are starting to see Robinhood and others tokenizing stocks, but these instruments are not living natively onchain. Fundamentally they are digital receipts (hint: IOUs, also known as debt).

Debt markets however; now they are in dire need of an infrastructure upgrade. For any bond or loan that is currently outstanding, there are human beings sitting behind desks who have to manually settle trades, send coupon payments, and keep track of who owns what. None of this is automated or programmatic. And access is strictly gatekept to a small number of institutional participants.

The Degens Love Debt

There is no meaningful public market for debt instruments, and global investors are hungrier for yield than ever before. This has allowed for onchain debt to achieve real product-market fit on Ethereum, and we are currently on a hockey-stick growth trajectory.

- Stablecoins

- LSTs

- LRTs

- RWAs

- Onchain lending

- Tokenized vaults

These are various forms of onchain debt that are growing like crazy. By onchain debt, I mean that these are all effectively IOUs, or receipt tokens representing something else.

- IOU = “I will get paid back at some future date”

There are two distinct risk vectors implicit in any IOU:

- CREDIT RISK = “I will get paid back”

- DURATION RISK = “At some future date”

While they may be inextricably linked, they are in fact different.

What's Duration?

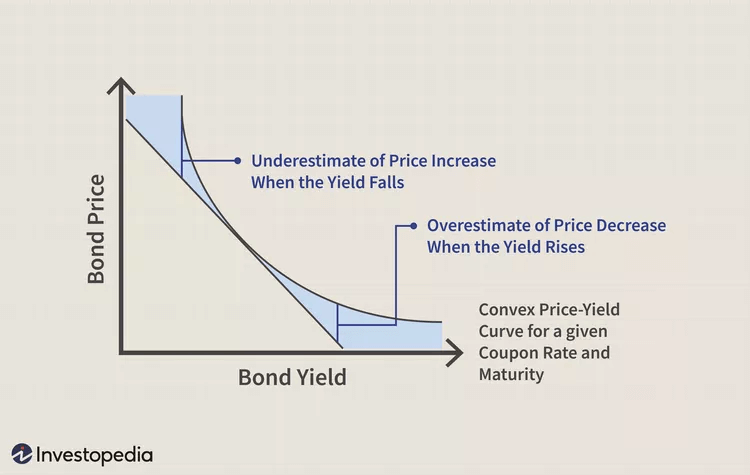

Duration is the sensitivity of an asset’s price to a fluctuation in interest rates. If I own duration, I should expect be compensated with some expected return for the opportunity cost of holding said asset until some future date.

To grossly oversimplify, Duration = Illiquidity. And illiquidity implies convexity, because the price of any asset will be more sensitive to changing circumstances (i.e more volatile) if it is illiquid. Liquidity dampens volatility. Keep this in mind for later.

The DeFi Debt Casino

As the stETH loopers know well, Pump.fun and Strategy aren’t the only games in town right now… DeFi debt markets have become a casino in their own right. We've seen a debt renaissance over the last 18 months, fueled by stablecoin growth and led by 10 all-star DeFi teams:

- AAVE: OG DeFi lending market, with nearly $60bn in TVL (!!)

- Sky (+ Spark): Largest stablecoin protocol in DeFi, formerly MakerDAO

- Lido Finance: Largest liquid staking protocol in DeFi

- Morpho: Cutting edge lending protocol; Growing like crazy

- Pendle: Onchain interest-rate swaps & tokenized yield trading; Growing like crazy

- Ethena Labs: Synthetic, yield-bearing dollar issuer; fastest growing protocol in DeFi history

- Maple: Leading onchain asset manager; Growing like crazy

- Euler Labs: Cutting edge lending protocol; Growing like crazy

- Veda: Leading onchain capital allocator and vault protocol

- ether.fi: Leading restaking protocol in DeFi

Collectively, these protocols make up the core infrastructure of the Internet Debt Machine. Here's how the machine works:

- Asset issuers like Sky, Lido, etherfi, Maple, and Ethena generate yield for individual token holders or onchain allocators like Veda and Spark, and incentivize users with points

- Token holders take their yield-bearing assets to Morpho, Euler, or AAVE to borrow against them, buy more yield-bearing assets ("looping"), and maybe earn some more points from the lending markets

- Token holders can take their assets to Pendle to speculate on fixed vs. floating yields, and maximize the points they are earning (Pendle is the hub for all DeFi incentives)

Even if we just isolate the points or token (hint: equity) emissions component the yield, I would still call this debt. Lenders just own equity upside. This is actually what Venture Debt looks like today, and what the US High Yield bond market looked a lot like in its infancy with the use of warrants. Which makes sense; DeFi looks a lot like other nascent debt markets.

Do you want to know what else is abundant in other nascent debt markets? Risk. All of the assets involved in this system carry both credit risk AND duration risk, regardless of whether or not token holders acknowledge this fact.

Yields Up... Prices Down

If rates go up, the present value of my asset will go down (remember bond math 101: rates up, prices down, and vice versa). This is true for all credit assets—from loans and bonds in TradFi, to tokenized vaults and LST/LRTs onchain.

Which is exactly what we saw last week as stETH depegged by 30bps:

- Justin Sun withdrew ETH from AAVE

- ETH utilization spiked, sending borrow rates soaring (rates up)

- 10X leveraged stETH loopers became unprofitable

- Traders try to unwind their levered loops by selling stETH for ETH (price down)

- stETH depegs as traders race to avoid the growing unstaking queue

Even stablecoins carry some duration profile, and thus carry some interest rate risk—they just happen to be short duration and therefore most liquid instruments. But even those short duration assets are not necessarily money good 100% of the time.

We saw this when USDC depegged in March 2023, where there was a bank run caused by… you guessed it, duration risk. And so, poorly managed duration risk in the SVB fixed income portfolio led to a material increase in credit risk, and we saw USDC depeg, as Circle had reserves with SVB. This kind of negative feedback loop is called a credit contagion. It’s a vicious cycle fueled by convexity, where risk begets more risk, and it can end in the kind of death spiral we in crypto when UST depegged in 2022.

The economic risks in DeFi are pervasive; so why is no one talking about them?

AAVE Worked Too Well

I would argue that credit risk in DeFi has been poorly understood from the beginning. And this is largely due to the origins of the Internet Debt Machine during DeFi Summer (I wrote a Substack last year on the History of Crypto Lending Markets if you are interested).

Smart-contract-based lending platforms like Compound and Aave were so successful that they made us forget about credit risk. You don’t have to trust anyone, the code will protect you as a lender. Sure there is smart contract risk, oracle risk, and liquidation risk (I would call this protocol credit risk), but these protocols functioned so well through market stress that we forgot that the credit risk is there. It's mitigated by smart-contract-based lending.

What About Duration Risk?

It turns out that once again, AAVE and other similar protocols actually did a really good job mitigating this with a floating rate mechanism. But again, it’s still there Many people call AAVE “the onchain risk-free rate,” and its stablecoin yields often trade tighter than US Treasury yields (the TradFi risk-free rate).

I asked ChatGPT what would happen if a large percentage of AAVE lenders all hit the withdrawal button at the same time. Here’s what it told me:

- Not everyone would get their money immediately

- Utilization would spike to 100%

- Withdrawal requests would be place in a queue

- Borrowers would face soaring interest rates

- Liquidations and system stress could follow

All DeFi deposits carry some duration, and thus illiquidity risk. Neither Lido nor Aave nor any other DeFi protocol can offer guaranteed instant withdrawals. Liquidity always depends on real-time conditions.

Live, Laugh... Lever Up

So what are the degens doing? They are levering up of course. Yield farming activity is being fed by:

- The points meta (i.e. token/equity emissions)

- Tokenization of yield trading on Pendle

- Shiny new assets like Apollo's ACRED and other RWAs to play with

- Lazy loopers automating 10X leverage on Contango et al.

To be clear, I do not think there is anything morally wrong with this. It’s a free market and individual actors are free to take as much risk as they would like. Personally I am a fan of many of these trades. No crying in the casino.

But I also think a degree of skepticism is warranted. This is the “DeFi ouroboros” that Vitalik has criticized in the past, and it’s what turns people off DeFi. If we’re not careful, we are going to hyper-financialize our way into the next GFC. How? Via some old friends from 2008: adverse selection & moral hazard.

Adverse Selection In Tokenization

Do you want to know the dirty little secret about real-world assets? Many RWAs are the TradFi rejects that couldn't find liquidity in the "real-world"—so they come onchain in search of it. This is the dark and too-often-ignored underbelly of tokenizing RWAs: the rampant adverse selection problem.

Bringing 8-12% yielding paper from big name TradFi shops onchain sounds great in theory. But a lot of times it’s lipstick on a pig. Private credit in particular is tricky because its such an opaque market. Many of these assets appear fine on the surface but are trading at significant discounts in secondaries (25%+ yield to maturity)… that is what we call distressed territory.

This is exactly the same issue we have seen with some of the early RWA experiments (Goldfinch in particular). Severely mispriced distressed credit marketed as “uncorrelated RWA yields”… Uncorrelated RWA yield sounds great right? But when borrowers default, onchain allocators and retail are left holding the bag. Crypto already has more than enough systemic credit risk, we don't need to be importing any more of it from TradFi.

Moral Hazard In DeFi

The new DeFi yield ponzi metas are not as bulletproof as the original DeFi money markets. And increasingly, they are reliant on centralized operators. This is not necessarily a bad thing, as I do believe the vault curator model, with professional risk managers at the controls operating complex protocols, makes a lot of sense. And I do believe wholeheartedly that reputable issuers tokenizing RWAs is core to the future of DeFi. Tokenization is the only path to trillions of TVL.

But most are complacently viewing the new wave of yield-bearing assets in the market as “decentralized” when they are the furthest thing from it. Just because your new favorite yieldy asset is an ERC-4626 doesn’t mean anything. On the backend, many of these tokenized vaults are multisigs with a few individuals handling billions of dollars from their laptops with no oversight, self-reporting TVL and other metrics to users and oracle providers alike.

And on top of it all, new protocols and asset issuers need to compete for TVL in a market that is 100x more competitive than it was in the 2020-2021 early DeFi era. Which means they need to achieve higher yields… by any means necessary. If that sounds familiar, you have probably heard of Celsius and BlockFi, and there should be alarm bells going off in your head. There is moral hazard here.

The Opportunity

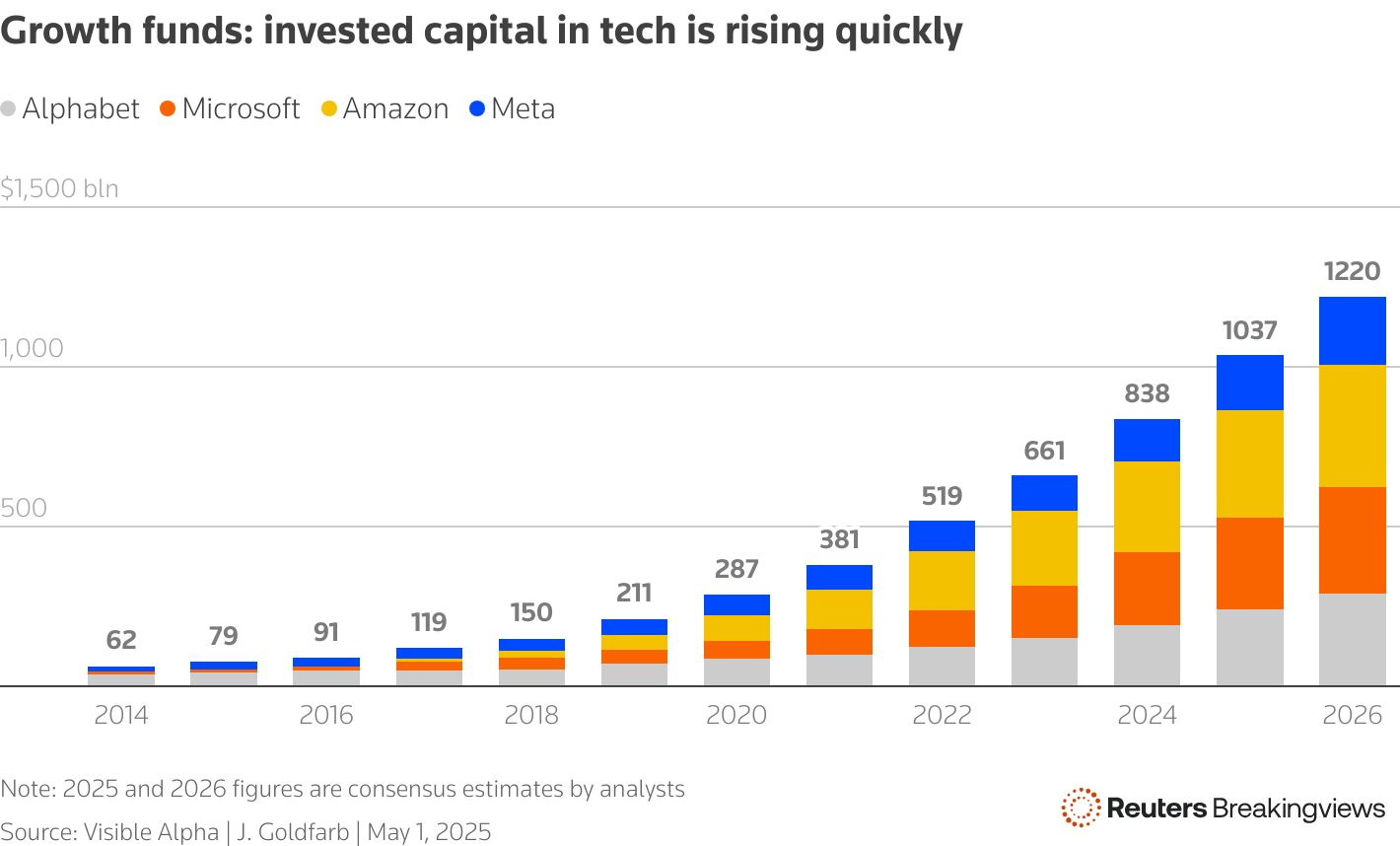

CapEx is back en vogue. The world’s biggest tech companies have set 11-figure budgets to pay for the chips and data centers they need to compete in the AI arms race.

It turns out that in the age of AI & robotics, building the future is capital intensive, and will need to be financed with debt. Ethereum has the opportunity to power this transformation as a global machine for digital debt origination and yield distribution.

Believe In SomETHing

Today is a great reminder that we are only 10 years into the experiment that is this alternative, internet financial system. I am incredibly bullish about Ethereum becoming the Internet Debt Machine—so much so that I have dedicated my career to onchain debt markets.

As an industry though, we need to be very careful about the quality of the assets we are allowing into the ecosystem. And we need to ensure that the assets that do come onchain are fairly priced. We also need professional risk managers who are held accountable for the onchain assets they are responsible for allocating. There needs to be infrastructure that allows for transparency. Otherwise we will just be speedrunning the same mistakes that have been made in the past.

If DeFi wins, the winning protocols are going to scale into the trillions. That means risk is going to scale as well, and it’s going to go scale exponentially. The amount of risk in the system will do a 100X from here before anything else does. That’s what keeps me up at night, but it’s also the opportunity that gets me most excited. This is exactly why we are tokenizing risk & building onchain credit default swaps at Cork Protocol.

If you made it this far, thank you for indulging me on this 3330 word treatise. Please DM me so we can nerd out about this stuff together.

Luke Chmiel - Head of Growth

.png)