Duration Risk in DeFi: The Hidden Threat Behind Looping Unwinds and RWA Scaling Challenges

August 25

10 mins read

Duration risk is one of the most underestimated threats in decentralized finance. It’s the hidden force behind looping trade collapses like the stETH unwind, and a critical barrier to scaling Real-World Asset (RWA) adoption. As DeFi integrates more yield-bearing strategies and tokenized credit markets, understanding and mitigating duration risk will be essential to sustaining liquidity, maintaining pegs, and unlocking the next wave of capital inflows from traditional finance.

What is Duration Risk?

Duration risk is the risk that the market value of a fixed‑income‑like position will change when the discount rate used to value its future cash flows changes. Practically what this means is that if you hold a bond and risk free rates change, the value of your bond decreases. The longer the maturity, the larger the value decrease is. In crypto, the relevant rates are not just short-dated T-bills, but also the USDC/USDT borrow rates on lending markets.

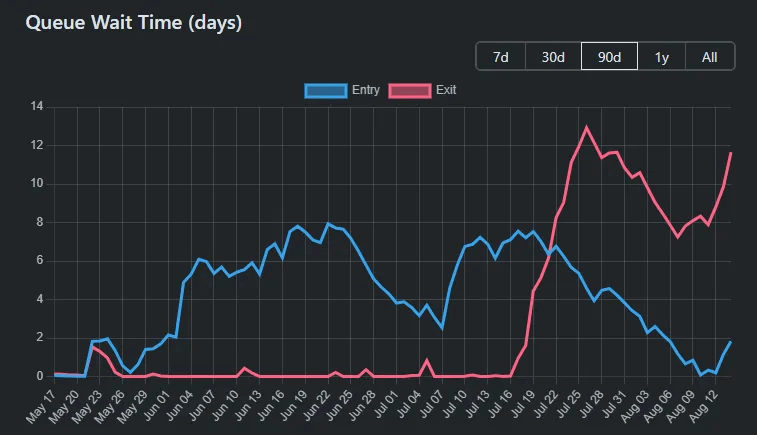

In crypto, duration risk rears its head largely as a result of major market shifts which drive rate changes and large redemption volumes that combined can cause significant losses. A good example is the wstETH:ETH looping trade unwind. In July 2025, positive price movements drove up the borrow rates across lending markets. Loopers were rate arbitraging the delta between the stETH yield and the ETH borrow rate on Aave by depositing wstETH as collateral to borrow ETH which is used to buy more wstETH which again is deposited as collateral in a loop. Because wstETH loopers receive a relatively stable rate of yield, but are exposed to variability on the borrow rate, effectively loopers are short duration. When borrow rates spiked, there was a looping unwind that caused the validator exit queue to grow to 12 days which caused a depeg of stETH.

As a result, loopers were stuck for a while holding negative rates or exiting into a depegged stETH market. This is an excellent example of how duration risk can unfold and wreck looping trades, because even just a 12 day increase in exit duration in the context of borrow rate spikes caused major market turmoil and significant losses. At the time of this writing, we have a second leg to this unwind occurring, I encourage you to read my initial lengthy explainer which dissects the exact mechanisms and math behind the unwind.

Another angle to duration risk, is the management of duration mismatches. A Vault offering a 1 week withdrawal window with assets across strategies with a 2 week redemption duration could face temporary liquidity crunches due to the duration mismatch of their assets and liabilities, often necessitating cash buffers that lower capital efficiency. Another example is if a bridge rehypothecates deposits into vaults, such as the case of the Katana VaultBridge which deposits funds into conservative Morpho Labs Vaults, they may face duration mismatch challenges. The challenge arises from the high utilization in Morpho Vaults (often 90%), which means only 10% of bridge funds are available for instant withdrawals. Whilst there is no real question on fund safety, this could cause real UX issues during volatile periods which may hurt some level of composability.

Fundamentally duration presents a challenge to DeFi composability, as it affects liquidity guarantee of yield bearing strategies. Organically to receive yield, capital often has to be locked up for a duration of time. The ecosystem is seeking to tokenize and embed these yield streams into financial products, which is one of the superpowers of DeFi, however, in the process this design pattern exposes users to duration risks during periods of market volatility. If DeFi cannot handle duration risk, it cannot absorb the vast majority of capital in credit markets which involves significant duration exposure.

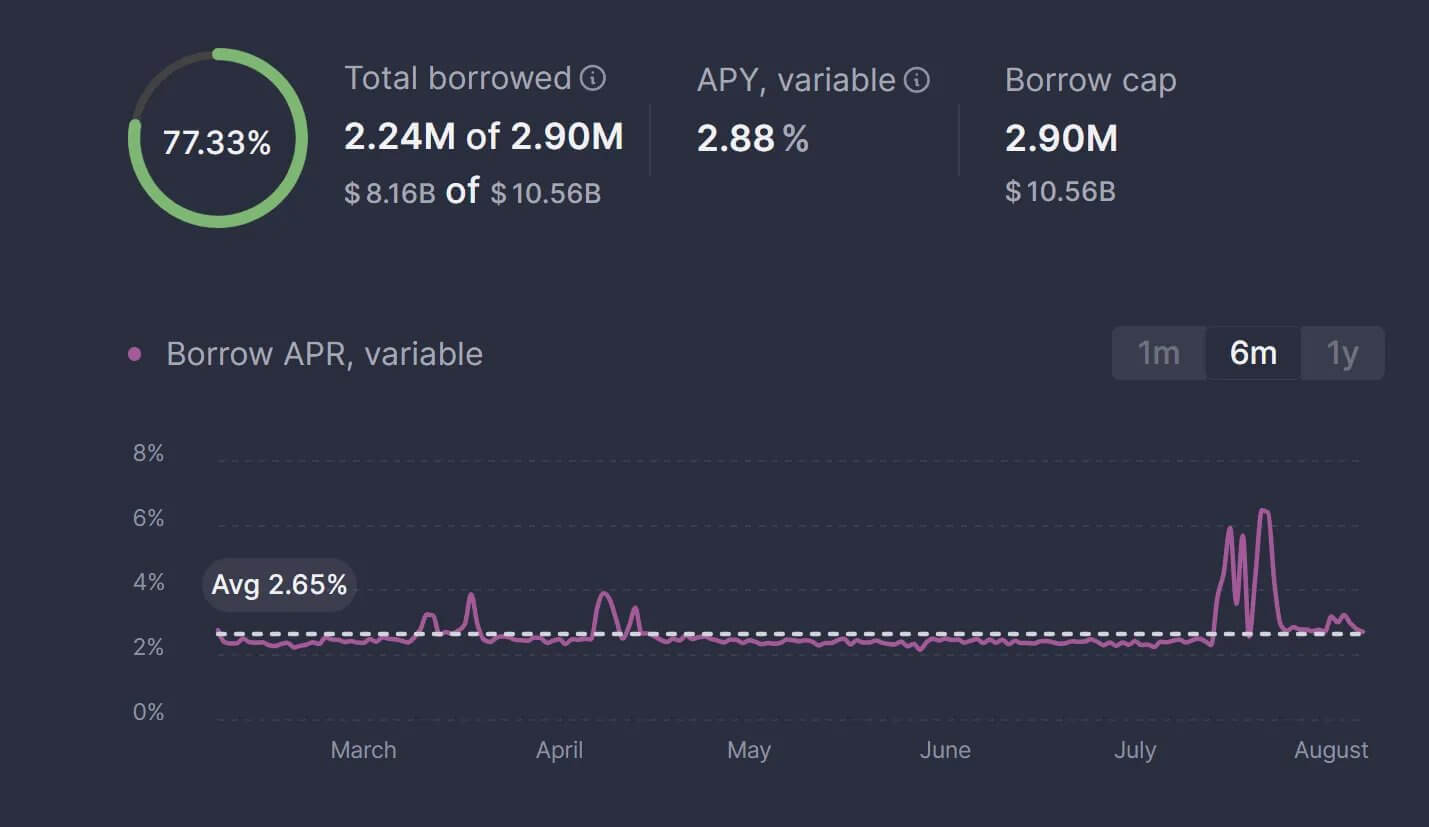

Duration in RWA Looping Trades

A form of RWA looping trade is the stablecoin basis trade loop, where USDe or sUSDe is used as collateral to borrow USDC or a similar stable, to leverage rate arbitrage between the USDC borrow rate and sUSDe yields. At the time of this writing, there is 6.2b$ of sUSDe, USDe and their relevant PTs on Aave alone, which is driving yield and utilization across their stablecoin markets. USDC and USDT have a borrow rate of 5%, whilst Ethena Labs is currently yielding 11%, providing an attractive rate arbitrage for loopers. In a sense, Aave is providing a low cost of capital at scale for the Ethena basis trade to be scaled up and down to match demand for perps.

In the case of Ethena, there is a relatively immediate redemption window and as such, the duration risk is quite minimal. However, to support this redemption profile, Ethena also must limit it’s collateral to immediately liquid sources, this explains the relatively minor exposure to stETH due to the exit queue duration risk. Likely, if Ethena rates would drop relative to the borrow rate on Aave, we will see a major loop unwind that will stress test the system. The result will be a significant Ethena TVL contraction, borrow rate volatility on Aave and likely a minor temporary depeg on USDe. Due to the short redemption window on USDe, the peg can quickly be arbitraged back up, but such an event would further battle test the ability of Ethena to rapidly process billions in redemptions.

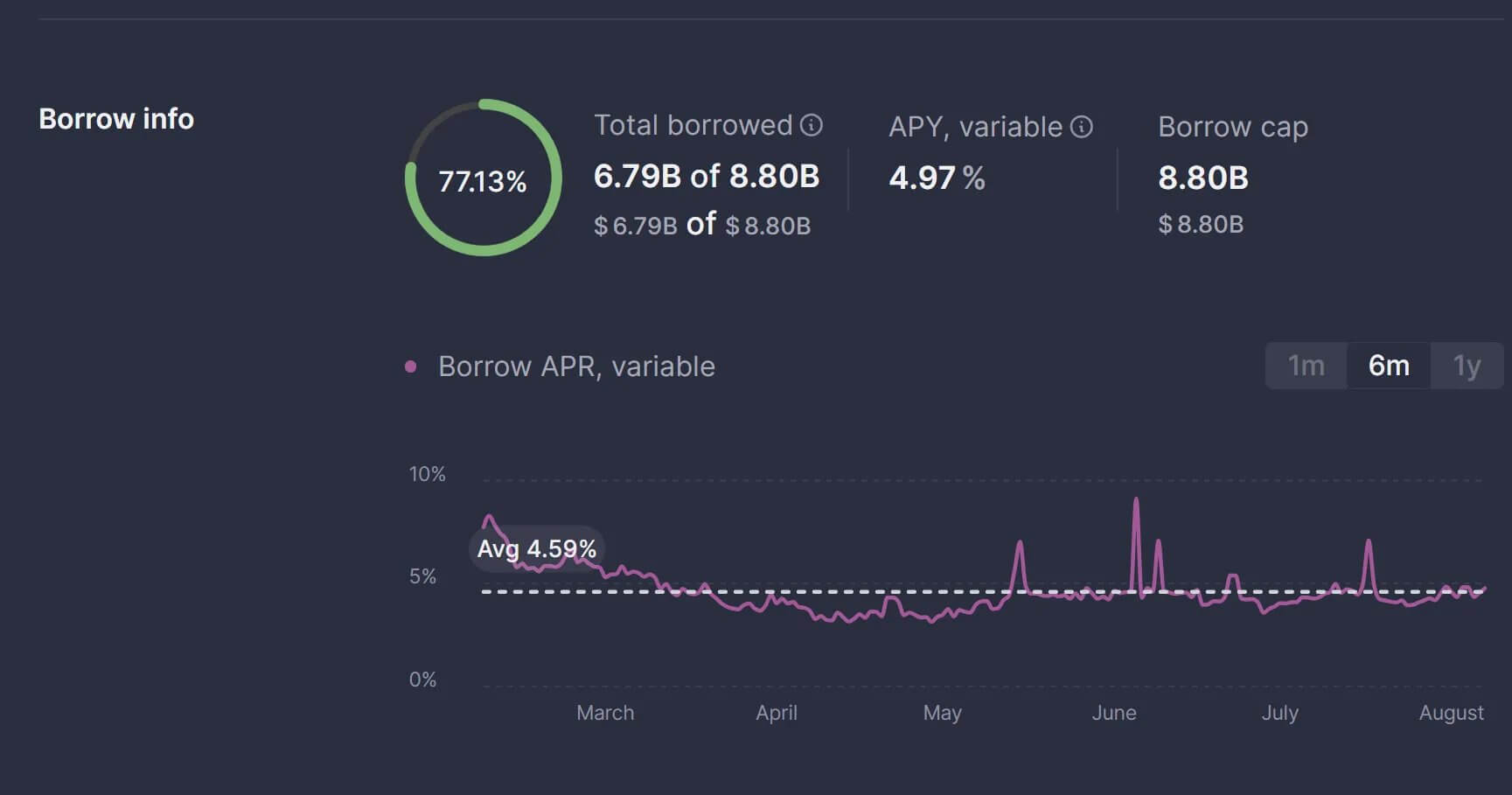

Illiquid RWAs

What happens when we do the equivalent trade without immediate redemption windows or liquid secondary markets? Currently there are efforts to perform looping trades using traditional credit funds. Many offchain credit funds yield 9-12% with relatively conservative risk ratings. If these can be levered up through rate arbitrage similar to Ethena, this would present a major opportunity to drive new sources of organic yield and expansion of credit instruments in DeFi. Such a market structure is being experimented with, for example the Securitize Apollo Diversified Credit Securitize Fund (ACRED) on Polygon which has 1b$ of AUM (100m$ onchain) is available as collateral on Morpho. This is a novel market yet to properly scale, but an exciting proof of concept of what is to come. Whilst ACRED yields 9%, it can be looped at a 3.6% borrow rate, providing an attractive rate arbitrage opportunity.

.jpeg)

However, there are two major duration related challenges for ACRED or other RWAs in scaling the looping trade:

1. The redemption window is often relatively long. For example ACRED has a quarterly redemption offer with a 21-42 day redemption window.

2. There is no liquid secondary market, finding a buyer to OTC offload can take many weeks.

In this context, loopers using ACRED or similar RWA style instruments, even with only 1-2 week redemption windows, face significant duration related risk. If rates flip such that the loop becomes negative ROI, how will the looper unwind their trade? If the trade is at 10x leverage, even a 3% negative APY for a month would amount to a 2.5% impairment of the collateral, a significant loss for a “fixed income” exposure. Furthermore, it creates some level of illiquidity risk for depositors on the lending markets, as it may not be so easy to liquidate positions when needed which may push lending markets up to full utilization in times of outflows, again resulting in further pain from rate volatility. This duration related risk not unique to looping, it affects any use case where RWAs are used as collateral. Solving duration risk for RWAs is a major challenge preventing their use in DeFi.

How to Solve Duration Risk for RWAs

To tap into the cheaper cost of capital of onchain lending markets, RWAs need liquidity facilities that mitigate their duration risks. One novel method for solving this is Cork, which offers the ability to set up markets where a Reference Asset (such as ACRED) can be immediately swapped for a liquid Collateral Asset such as sUSDS. This serves as a swap line or instant liquidity facility. The facility solves the duration issue and enables an underwriter of the facility to earn a premium from providing coverage of the duration risk, introducing a new DeFi native yield source. This solution has the potential to significantly change the risk profile of RWAs or other semi-illiquid yield bearing assets that take part in the lending market rate arbitrage game. In the same way Aave has driven 6.2b$ of USDe supply through it’s rate arbitrage game, likely the RWA rate arbitrage if designed correctly could meaningfully scale the size and opportunity of onchain lending markets and the TVL of RWAs in DeFi.

Cork will soon pilot the first markets where the facility is solving duration mismatch/risk use cases in DeFi which may unlock a meaningful new category of yield and arbitrage opportunity.

Duration risk in DeFi is real as we can see by the stETH looping unwind, and as an ecosystem we need better tooling and strategies to understand, manage and overcome this risk. Risk management is the new frontier, as DeFi prepares to accept trillions flowing from traditional financial rails.

Follow Rob on X for more insights and sign up for the Cork newsletter to get them in your inbox.

.png)