.jpg)

Why is Everyone Launching DAT Companies?

August 2025

6 mins read

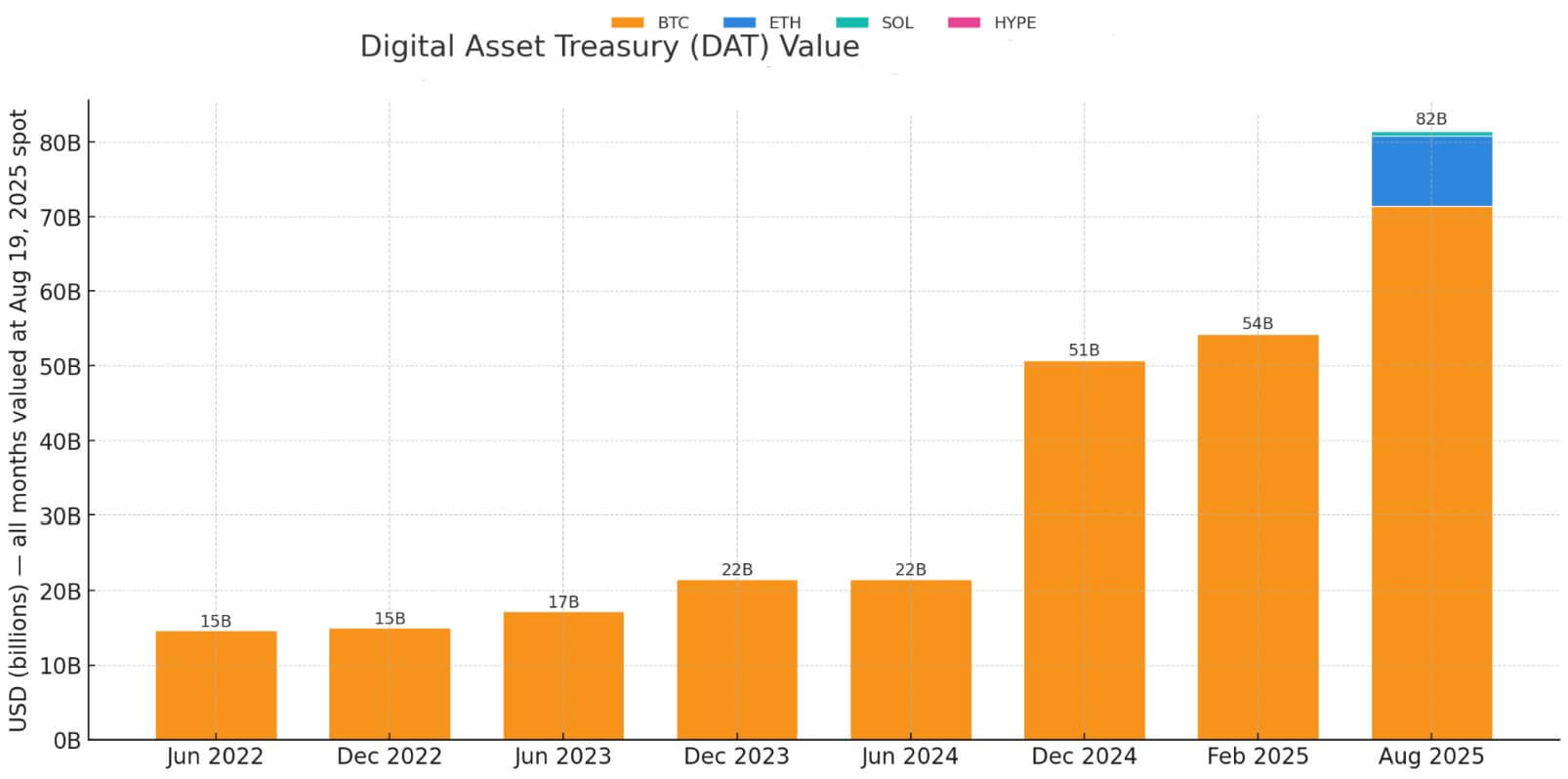

Let’s explore the fundamentals of the DAT model and why it is a beautifully orchestrated arbitrage ponzi that has accumulated over $80B of crypto assets.

The Arbitrage Method

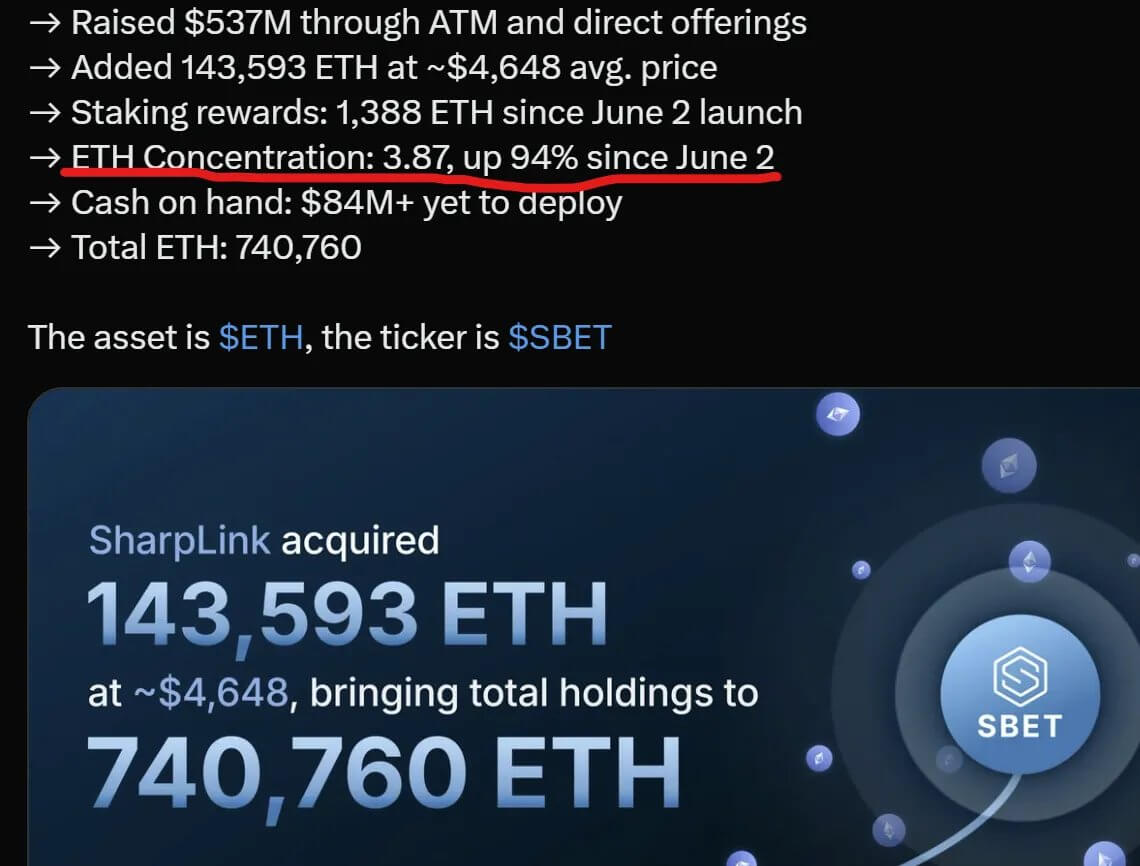

The core objective of a DAT is to increase the crypto holdings per share. For existing shareholders, this means you receive a “yield”. For example SharpLink Gaming increased their “ETH Concentration” per share by 94% in about 3 months. How did they do this?

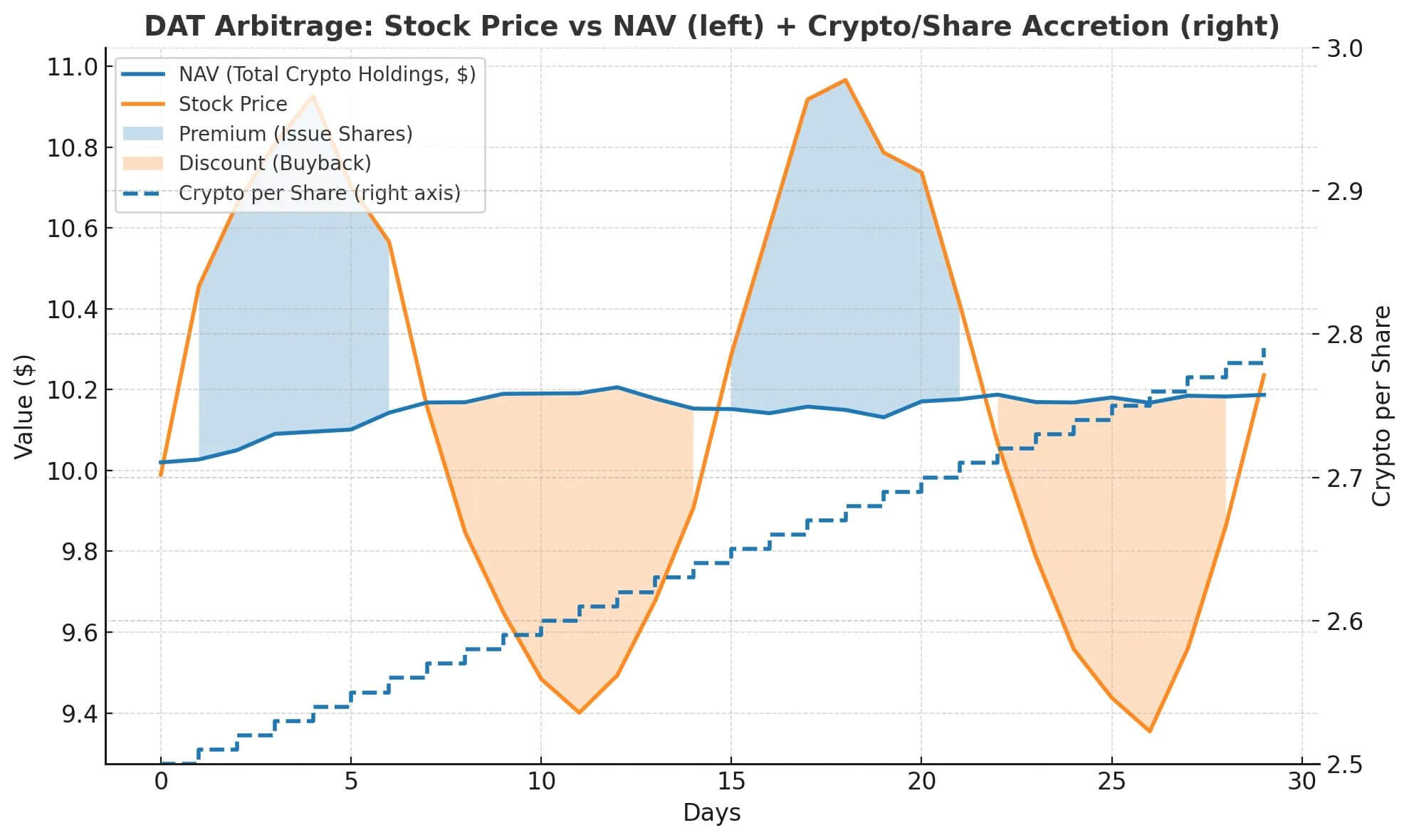

The way this yield is achieved is through arbitrage of the Net Asset Value (NAV) relative to market cap. If the $SBET NAV per share is $10 but the stock price is $15, the multiple of NAV, often referred to as “mNAV” is 1.5.

When the mNAV is above 1, there is an arbitrage opportunity the DAT can perform by issuing new shares and selling these At The Market (ATM) and buying crypto with the proceeds. This increases the crypto holding per share as long as mNAV is above 1.

When you buy a DAT share, you are thus betting that the stock will continue to trade at a premium, such that you may continue to benefit from the arbitrage. This is one reason why DATs are a form of sustainable “ponzi game”, because it is the expectation of future buyers continuing to keep the mNAV inflated that makes the trade profitable to begin with. The earlier you enter the trade and the longer the stock trades at a premium, the larger the crypto yield.

Downside Scenario

Now calling this a ponzi game makes it seem like the whole enterprise will collapse if the buyers stop flooding in, which is NOT the case with DATs. What happens when inflows are surpassed by outflows? If the stock is trading below the NAV, (mNAV below 1), stock buybacks that effectively do the inverse of stock issuance, are executed to further increase crypto per share. Buybacks can be funded by selling crypto holdings or leveraging cash on hand. This further produces yield for DAT shareholders, making the arbitrage accretive on both the upside and the downside.

DAT Permanence

A key idea of DATs is that they will be long term buyers and holders of crypto that will not sell in a downturn. I would contest that notion. As Charlie Munger famously said, “show me the incentives and I will show you the outcomes.” DATs have a fiduciary duty to increase shareholder value and selling crypto to buyback shares when they are trading below mNAV of 1 is the optimal strategy to maximize crypto per share, which is the purpose of the vehicle. For example Tom Lee’s Bitmine Immersion has already authorized $1B of buybacks to be performed in response to BMNR trading below mNAV of 1.

Michael Saylor has stated Strategy will not sell their holdings even if there is a discount to NAV. Because of dilution, Saylor doesn’t have voting control of Strategy anymore, so I suspect shareholder incentives will decide the outcomes in the end, which would indicate dumping of BTC in a downturn to perform buybacks.

The Blowup Risk

The only real blowup risk in DATs stem from the use of leverage. None of the ETH DATs currently deploy any leverage. The use of leverage can further increase crypto per share without dilution, however, the cost basis begins to matter for purchases using leverage. If you borrow money to buy ETH and the price of ETH drops, that’s a loss that all DAT shareholders will have to absorb. In the inverse scenario, profit accrues to shareholders. Only Saylor’s Strategy has meaningful leverage ($5.2B non-converted debt, $3.95B preferred stock). As the market reaches the later stages of the bull market, my only worry is that DATs begin to lever up at the wrong time and go deeply under-water as a result. This could nuke crypto prices in a bear market, similar to the unwind of 3AC or FTX. However, we are yet to see this and several of the ETH DATs have expressed very conservative views on the use of leverage.

Future of DATs

I believe we will see the proliferation of DATs across many tokens and possibly other commodity markets (e.g. gold) with limited supplies. On some level, a DAT is a form of “token IPO”, which opens access to crypto exposure for new pockets of capital such as mutual funds, certain ETFs and wealth advisors. Whilst many blue chip tokens will likely launch ETFs in the future too, there is a broader set of tokens which will have DATs. Already today HYPE, ENA and SOL have major DATs, each with hundreds of millions in holdings.

From first principles, having broader market access is a positive part of the trend of crypto and traditional finance rails merging. Whilst these vehicles push short term buying pressure, they likely are not long term fundamentally altering the value of the tokens held. Whilst a token being more widely held and liquid across more venues may add some premium, ultimately it is the underlying protocols and networks’ actual adoption which will determine the success of the tokens over time.

In the short term, the market is a voting machine, in the long term, it is a weighing machine. DATs bring many votes, but they don’t bring real weight. Heavy is the protocol with a strong product and network effect. Let us not forget why we are building the future of finance.

Follow Rob on X for more insights and sign up for the Cork newsletter to get them in your inbox.

.png)